You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Aside from charting tools and market research, there are two important but often overlooked decisions for a trader to make; choosing a brokerage firm and a specific broker. Each of these decisions are capable in having a profound impact in your overall trading results and you owe it to yourself to take the time to make an educated judgment.

Choosing a brokerage firm

Deciding on a brokerage firm is a significant decision and shouldn't be taken lightly. Before committing to a firm it is imperative that you research their services, experience, trading platforms and commission structure but more importantly whether your trading style and personality will be compatible. For example, a beginning trader shouldn't look to a deep discount...

Are you like many investors who go to sleep each night feeling safe and secure because their investment portfolios are properly diversified? Conventional diversification attempts to decrease risk and offer more opportunity for the average investor. However, when we observe conventional diversification protocol through the objective eyes of pure supply and demand, it becomes quite clear that conventional diversification actually increases risk and decreases opportunity.

The Foundation: Quantify Supply and Demand

As I have repeated so many times, the movement of price in any and all free markets is a function of the laws of pure supply and demand. Low risk/high reward buying and selling opportunity emerges when this simple and straight...

If "volume precedes price" as is often suggested then it should be possible to apply analytical techniques to certain volume attributes that will have some predictive capabilities with regard to future price development. Using various techniques that come under the general heading of money flow analysis it becomes feasible to decide whether a particular security is being accumulated or distributed. A security that is undergoing accumulation can be expected to gain in price and a security that is displaying the characteristics of distribution will probably offer opportunities on the short side. Equally, it can be very informative to see whether there are divergences between the security's price behaviour and its volume behaviour.

The...

The author of A Complete Guide to Technical Trading Tactics: How to Profit Using Pivot Points, Candlesticks & Other Indicators, looks at a candlestick formation that can indicate reversal points when used with pivot points and support/resistance levels.

There are many trading methods one can employ to actively trade including various mechanical trading systems and manual trading tactics. The constant changing of market conditions can require system traders to adapt and update the parameters for the trading decisions. I often prefer the hands on visual approach which is more of a manual method while employing mechanical risk management techniques. The visual approach is aided by the use of candle charts. The draw back is one must have a...

Chart patterns capture the development of crowd emotion and provide potentially high

probability trade ideas with well-defined price targets and exact measures of risk

management. But patterns - by themselves - do not necessarily lead to consistent outcomes. The development of chart patterns only alerts traders that one particular type outcome is more likely to occur than another. As price moves towards a selected price point, the trader pays more attention to the stock, ready to place a buy order if prices move a few ticks above that level. In other words, chart patterns signal that trading potential and the probability to take action may exist.

Chart patterns are an invaluable aid to trading, but only when they point the way to high...

Do you have trouble pulling the trigger? If so, you're not alone. Greed and fear exert a powerful influence when the time comes to enter the trade. This is especially true for newbies who have great difficulty visualizing the rewards or risks they're about to incur.

Effective trade entry requires skill, confidence and a strong stomach. Most of the time it should be an uncomfortable experience; no one likes to lose money. But the ability to follow a disciplined entry plan, even when it hurts, separates profitable traders from the hordes of losers who take up the game.

I receive dozens of questions each year from frustrated traders who aren't sure when to be in or out of positions. I've compiled the best ones here today, along with...

What is a trading arcade?

A trading arcade, proprietary trading group or trading bureaux are some of the commonly heard names for a company that provides risk management, additional leverage, professional software and hardware infrastructure, trading facilities with analyst support and sometimes training and capital backing to traders in return for a share of trading profits and/or commissions.

At an arcade, you would typically find a spacious trading room filled with desks: well equipped work area's with high spec workstations, arrays of screens and terminals providing access to market data & depth, quotes, charting, Reuters, Bloomberg, Sky TV and the all important trade execution platform. The name trading arcade probably originates...

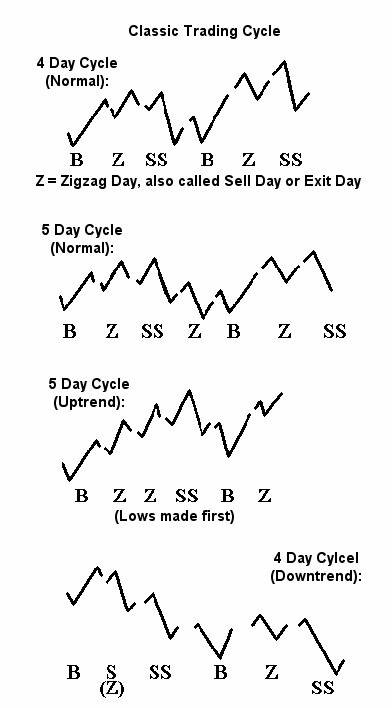

My personal trading style is based on a method described in the 1950s by a veteran floor trader named George Douglass Taylor. The "Taylor Trading Technique" is a short-term method for trading daily price movements that relies entirely on odds and percentages. It is a method as opposed to a system. Very few people can blindly follow a system, though many find it easier to be discretionary in a systematic way.

Because this short-term swing technique generates frequent trades, it is important to know the correct plays, when to lock in profits, and when to seek the true trend. Taking a loss is merely playing for better position. One trades strictly for probable future results, not for what the market might do.

To know the correct play is...

The CFD market has expanded rapidly over the last few years and a number of innovative new products have resulted from the strong following that CFDs now have. One of those developments is CFD SIPPs. For those of you not familiar with SIPPs, they are Self Invested Personal Pension Plans which basically represent your pension fund, but instead of handing the management of those funds over to a pension fund company, you are able to manage it yourself. The range of investments available to you is very broad, including commercial property and of course stocks and shares. Recently the legislation has changed and you can now use CFDs as a means of trading equities within your SIPP. Now before I go any further, I hasten to add that I am not a...

Volume patterns are much harder to interpret than price patterns. The difficulty stems from the clandestine strategies of big market players. These folks tend to move slowly and cover their tracks within the broad noise of daily movement.

While price bars tell many tales in a vacuum, volume has little or no meaning without underlying price movement. But don't abandon your volume study just yet. It still adds power to prediction when you apply it judiciously.

The importance of volume depends on its location within the overall pattern. For example, heavy volume through a broken trend line suggests the start of a new trend, while the same activity after a long rally or decline predicts a reversal. This counterintuitive logic confuses...

Capturing Trend Days

Trend days occur when there is an expansion in the daily trading range and the open and close are near opposite extremes. The first half-hour of trading often comprises less than 10% of the day's total range; there is usually very little intraday price retracement. Typically, price action picks up momentum going into the last hour -- and the trend accelerates.

Classic Trend Day - A large opening gap created a vacuum on the buy side. The market opened at one extreme and closed on the other. Note how it made higher highs and higher lows all day. Also, volatility increased in the latter part of the day--another characteristic of trend days.

A trend day can occur in either the same or the opposite direction to the...