You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

In my 10+ years experience in the Forex trading industry, one of the most common debates I've seen traders engage in is fundamental analysis vs. technical analysis. Which one is better? Which one should be used for trading?

For me, it's a no-brainer: the answer is both. Even if you are an intraday trader trading off the tiniest moves in the Forex market, having some idea of the fundamentals can alert traders to changes in regulations that effectively alter the game. So, at the very least, fundamentals are important because they may affect regulation, which affects all traders regardless of their approach. Because traders need to be aware of regulatory changes that inherently alter the game of trading, they will benefit from monitoring...

How would you like to make $1,287 in 10 minutes? Well, if you had purchased a $100,000 lot of U.S. dollar/Japanese yen on Dec. 10, 2003, at 107.40 and sold 10 minutes later at 108.80, you could have. It would have worked like this:

1. Bought $100,000 and sold 10,740,000 yen (100,000*107.40)

2. Ten minutes later, the USD/JPY increases to 108.80

3. Sell $100,000 to buy 10,880,000 yen, to realize a gain of 140,000 yen

4. In dollar terms, the gain would be 140,000/108.8 = $1,286.76 USD

So, who was on the other end of the trade taking the huge losses? Believe it or not, it was the central Bank of Japan. Why would they do this? The act is known as an intervention, but before we discover why they do it, let's quickly review the economics of...

So you’ve probably read many blogs, forums, websites, books in which you are now in a sublime state of happiness in regards to trading the financial markets?

Perhaps you’re an optimistic individual and honestly believe you can double your money in the financial markets? Yes you probably could. Some traders enjoy muted levels of volatility and some just can’t get enough of high volatility environments. What does it matter? Whatever tickles your fancy, one thing is for certain – You will lose money trading the financial markets.

If you can’t handle that then please look away from trading now and find yourself another hobby.

Of course the area of trading is subjective but no doubt trading will give you a losing trade, perhaps even 15...

Most traders are reluctant to buy breakouts, for fear of being the last one to the party before prices reverse with a vengeance. So, how can they learn to trade breakouts confidently and successfully? The "do the right thing" setup is designed to deal with just such a predicament. It tells the trader to buy or sell when most ingrained lessons are against doing so. Furthermore, it puts the trader on the right side of the trend, at the times when many other traders are trying to fade the price action. Read on as we cover this strategy and show you some examples of how it can be used.

Do the Right Thing

In the "do the right thing" strategy, the capitulation of top and bottom pickers in the face of a massive buildup of momentum, forces a...

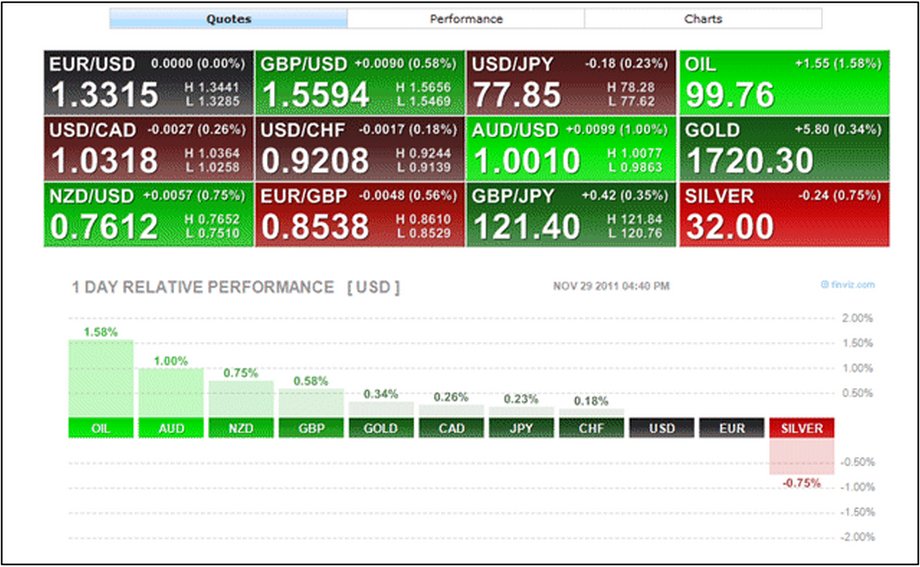

As we end 2011 the Eurozone debt crisis has taken centre stage. Even for the most hardened technical trader it has been difficult to ignore the fundamental noise emanating from Brussels.

This reached fever pitch after the EU summit on 8-9th December was deemed a massive failure. So as we enter a New Year, traders who want to keep their profits need to get used to fusing fundamental and technical analysis when they trade the markets.

For example, EURUSD dipped below 1.30 on 14th December. This was a huge move since it was the lowest level for the single currency for 11 months. 1.30 was like the Rubicon for the FX market – it was considered a point of no return. Not only was it of major technical importance but it also had fundamental...

There are many reasons why I enjoy teaching students how to trade the financial markets of the world, ranging from the satisfaction I obviously get from helping others, to knowing that I am helping people to protect the capital they worked so hard for in the first place, and also when I discover something new for myself! That's right; I also learn new things not only from my students, but also from researching and explaining ideas and topics in the teaching environment. This very week I have been teaching and have been focusing on the most effective way to screen for equities to swing and position trade. I was showing the guys in the classroom how to use a great website called Finviz to screen for their stocks to trade, when I noticed...

Europe may be in calmer waters after the currency bloc’s leaders hashed out a EUR 1 trillion plan to save the currency bloc and pull Greece out of the way of default, but the last few weeks have taught us valuable lessons that we would be wise not to forget. Trading is always risky and there are always events that can happen that you can never plan for.

Trading currencies is even riskier. Since a currency ‘s value depends on a huge multitude of factors including politics, economics and even social issues, you can prepare as best you can, but the chances are at one time or another you will get caught out.

For example, a developed western nation had not defaulted for nearly 70 years, yet here we are talking about how close Greece was to...

Continuing on from last week, I am hoping to give even more compelling reasons to consider other trading approches to that of only day trading.

Profit per hour of trading is hugely inefficient for day traders

When day trading currencies it is not unusual to be at your pc for up to 10 hours a day. If you are fortunate enough to be able to make a net profit of $200 per day (which most people are not able to achieve) then that is the equivalent of earning $20 per hour which is not unreasonable earnings. Most people who day trade don’t make anywhere near this amount and many spend 10 hours a day in front of their pc and end up with a net loss on the day. It is also very difficult to be able to do anything else when in a trade and requires...

In recent times there has been a huge increase in the number of people trading currencies or forex as it is more commonly known. Most of those taking up this venture have turned to day trading as opposed to position trading or swing trading as their chosen approach. As a longer term trader myself, I am at a loss as to why so many choose to day trade when it is highly inefficient and ultimately costs a lot more in both time (sat in front of a pc all day) and money (commissions or cost of the spread). I can though easily see why the retail providers of forex trading facilities prefer day traders to any other type of trader and that is because it is much more profitable for them. As such they will market their services in such a way as to...

I had an interesting conversation with a colleague recently. He used a good analogy for recent market action: imagine if you had been away from a trading screen for the last three months, you then came back and were asked where you thought EURUSD would be. What would you say?

Probably 1.1000/ 1.1800 maybe. You have seen all the negative comments and the Sovereign debt debacle spread its tentacles into Greece, then Portugal and Ireland and now maybe even Italy, so surely the euro had to decline, right? Well no, it’s higher than it was at the start of the year.

This is a good analogy for market action in recent months since it has been extremely difficult to make money. Sure there have been some trends: EURCHF, USDCHF, GBPCHF, but other...

In this article I will examine more closely the common belief that those darn Forex brokers are "running" or "hunting" our stop loss orders. First, let's define what this means. Running or hunting stops basically means that you enter a long (short) position with a sell (buy)stop loss a few pips below (above) your entry. The price action then comes to your stop order, takes you out, then the price action immediately reverses direction – often going directly to your first price target! Has anyone had this happen to them before? Do a quick internet search and you will find tens of thousands of references to this.

There are two main problems with this belief. The first is the psychology involved with this belief. Do you REALLY believe that...

In previous articles we have spoken about our preference for combining technical analysis with macro factors and the benefits of keeping up-to-date with economic data, central bank speak and interest rate decisions.

In our view this is one of the best ways to create winning trading strategies. But recently it is easy to get extremely frustrated with the wave of fundamental factors that have caused havoc in the financial markets and had the potential to wipe out positions in an instant.

That can be extremely frustrating to a technical trader. We will look at a few examples here and try and give some tips on how to dodge those macro curve balls.

The first example is the US dollar and the Federal Reserve’s quantitative easing policy...

Choosing what currency to invest in can be a daunting prospect. If you want to invest in a company you can check out its latest accounting statement to get the basic information you need: whether it is making or losing money, how much debt is held on the balance sheet etc. But there is no similar snap shot for individual currencies. A successful forex trader needs to keep up to date with economic data, geopolitical tensions as well as political landscape since all of these factors can move forex markets.

But, luckily for FX traders, there are some historical relationships that help make sense of the wider currency market. Firstly, the safe haven. Japan may have a debt-to GDP ratio of close to 200 per cent, yet the yen is considered a...

In this article I will focus on the correlations of currency pairs and how they can help us trade. Occasionally, a trader may notice that a particular currency pair may lead another currency pair - that is, have turning points that happen a candlestick or two earlier. While it is rather rare for two different currency pairs to do EVERYTHING in the same way for long - be it trending or channelling - occasionally, we can be alerted to a potential turn in one pair when its dance partner turns first.

The first currency pair and its partner that we will examine is the EURUSD and the USDCHF. Before we examine the charts, always remember that with the USD on different sides in these two pairs, we have a reasonable Economics 101 belief that...

Over-trading is one of the biggest mistakes you can make in financial markets. Having a great idea and acting upon it before the time is right can lead to losses, even if the idea behind the trade is truly fantastic.

Take EURUSD. Ever since the European Central Bank’s January meeting ECB President Trichet has been labelled hawkish. Anyone who watches the interest rate markets would have seen the spread between German (proxy for Eurozone) and US government bond yields start to widen in Europe’s favour. Eventually, this spread equated to EURUSD reaching 1.4000.

This sounds like a good trade since FX markets are sensitive to interest rates, but as of the start of February this level has been elusive. For those traders who put the...

Information is integral for trading and markets wouldn’t run without it, but sometimes keeping on top of the constant flow of news, economic data, numbers and central bank speakers can seem overwhelming. Trying to read every piece of investment research can have a detrimental effect on traders as they get caught up in knots attempting to digest the many opposing viewpoints and trade ideas that permeate the market.

The most successful traders are not necessarily the most well-read; instead they can think clearly, formulate rational trading strategies and remain disciplined. One such trader was Nicolas Darvas. He made $2 million in 2 years trading the stock market during the bull market in the 1950’s. He wasn’t a fund manager or...

It is the job of every serious-minded Forex trader out there to keep abreast of the latest news and events, which could potentially have an effect on their day-to-day trading activities. This month is a big month for the world of Forex trading in that we have seen brand new legislation enforced which will no doubt ripple across the activities of all Forex traders participating or looking to participate in the markets over the course of the future. This ruling has been met with praise by some and scorn with others, yet needless to say, it is here to stay and we should all be aware of its appearance moving forward. The ruling I am talking about is the introduction of the latest Commodity Futures Trading Commission (CFTC) Compliance rule...

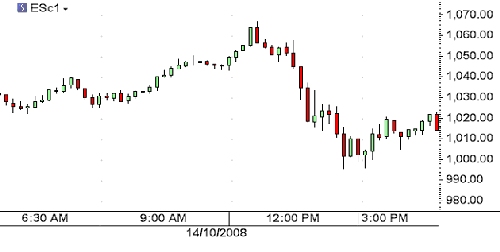

Many regular readers of this column know that I sometimes use cross-market analysis to find Forex trades. If you think that sounds complicated, keep reading and you'll see that it's easier than it sounds. You might recall last October's article, "Using Stocks to Trade Forex," where the S&P was used as an indicator to trade the GBP/JPY currency pair. Recently, a trade setup presented itself where I was able to use a major support level on the S&P 500 as an indicator to place a trade on another currency pair that is known to follow that index.

Let's begin with a very long-term look at the S&P 500; we can do this by checking the continuous monthly chart of the E-Mini futures contract. From this chart, it's very clear that the 800 area...

Given my background as a scalper in the equities market for eight years I am often asked if those same techniques are applicable to the FX market. First, it is important to define how one defines scalping. First, recalling my days as a floor/screen based trader of equities in the 90s the definition was a technique whereby a trader could profit from very short-term moves in the marketplace by using a combination of 1 & 5-minute charts as well as a keen sense of tape reading. When I made the transition to the FX markets exclusively back in 2001-02 I was keenly aware that this type of hyper strategy had 2 shortcomings:

It was not scalable

A scalping technique may not be conducive to the FX markets

While point 2 may be open to...

"Rather than maniacally trading volatile pairs multiple times in a single day, rule-based discretionary traders are now holding onto open positions longer, relying more on planning and patience rather than fast reflexes."

Rule-based discretionary traders are among the best traders on this planet. The trading strategy I want to explain here is a rule-based discretionary system. Every trader will face both winning and losing streaks alternatively, so the key to trading successfully is to make more money during a winning streak than you lose during a losing streak.

It's very disturbing that so many traders find it difficult to survive in the markets. The issue is; even if you're disciplined, it'll be difficult for you to survive with a...

12:05 Appraisal time. I'm back in my office, munching my sandwich and typing with one finger. The first one is Mike, which is actually pretty easy. He's experienced, thoroughly competent, and as far as his interactions with spot trading are concerned he's a model citizen. Done. Next! This one's tougher. It's a girl called Carla, who heads up the middle office functions here. I can't say we've always seen eye to eye if I'm honest. We've had a few run ins over the delivery of P&L and risk reports (both in terms of timeliness and also with accuracy). She's not producing them herself, but my personal thought is that she's had long enough now to whip that team into shape, having come over from our rivals, I heard, at no small expense to do...

06:00 Alarm goes and I'm out of bed. Hopefully I have managed to sleep all through the night, although on odd occasions I will get a phone call or a text message if anything particularly important is up. Not so often these days though. The people I work with know how much I value my beauty sleep. Quick shower and shave and I'm usually out the door some time before 0630

06.30 On the way to the tube station I will have a quick scan through the news headlines on my phone, check my e-mails, check the spot market levels in Asia etc. By the time I get to the tube station my phone has downloaded all the early morning research pieces that I've been sent so I have something more stimulating than the free papers to read on the train. It's a...

PM: = Paul Mullen (Interviewer)

JF: = John Forman (Forex Analyst)

You can listen or download this interview by clicking this link:

Forex Analyst Interview mp3

PM: Hello to everyone, from Trade2Win. Today I have John Forman with me, who is a professional Forex analyst. John is also an author, and has written a book called The Essentials of Trading, and if you wish to contact John, then details of how you can do this will be available at the end of our discussion. So, a very warm welcome to you John, and the first question I would like to ask you is what is a Forex analyst and what do they do?

JF: Well, in my case, I work for a division of Thomson Reuters, which is a name probably most people know, on one level or another. It's...

I'd like to walk you through a trade that was placed in October, using a technique that might seem a little unusual - the use of intra-market relationships and correlations to create trading opportunities in the Forex market. Sound complicated? It's really not, so please sit back and enjoy as we explore the use of the stock market as a leading indicator to trade Forex.

On Monday, October 13, 2008, the Dow Jones Industrial Average skyrocketed to its biggest point gain ever, a whopping 936 point move. The 11.1% gain was the biggest in percentage terms since 1933, and the fifth largest percentage gain in the history of the index. Similar moves were also seen on the S&P 500 and the NASDAQ, as the markets celebrated the end of capitalism as...

Over the past weeks, I have focused my weekly articles on strategies. I have tried to share with you the various strategies I see traders using and finding success with. Today, we will end the strategy series with far and away the most popular entry strategy, the "breakout". The Forex markets are markets that move. In a market that has significant and consistent movement, using breakouts is very appropriate. As with any strategy, there is a right way to understand and use it and a wrong way. In this piece, I will discuss the two most popular breakout entries; Support and Resistance Breakouts and Trend Line Breakouts.

Support and Resistance Breakouts

Once in a while I hear someone say that breakout trading worked best in the late 90's...

When it comes to trading, one of the most neglected subjects are those dealing with trading psychology. Most traders spend days, months and even years trying to find the right system. But having a system is just part of the game. Don't get me wrong, it is very important to have a system that perfectly suits the trader, but it is as important as having a money management plan, or to understand all psychology barriers that may affect the trader decisions and other issues.

Most Forex trading courses and Forex training programs forget about these important aspects of trading. But the truth is that in order to succeed in this business, there must be a complete equilibrium between all important aspects of trading.

In the trading...

When discussing market analysis, we generally consider the two contending schools of thought to be Fundamental Analysis and Technical Analysis. However, in the early 1970's, there emerged a third view known as the "Random Walk Theory", which was not so much an approach to market analysis as it was a critique of the other two methods.

The Random Walk Theory is the popular name for a market model known in academic circles as Efficient Market Theory. This model of the market contends that prices are "efficient" in the sense that all known information and market expectations are immediately factored into the market through the movement of prices. But these price movements are caused by so many different factors that they become random in...

As the online Forex trading market becomes increasingly saturated and the choice of brokers becomes wider, the decision of which broker to run with becomes increasingly important for the trader. Although the majority of brokers provide the same basic trading platform, there can be a vast difference in what they offer their clients, both in terms of trading conditions as well as customer support. By simply visiting a company's homepage it may be hard to separate the second-rate firms from the professionals, therefore this article will examine the main parameters that should be taken into consideration before creating an account and depositing.

Account type

The decision of which type of account to open will most likely depend on the...

First of all, congratulations to everyone who made money on the recent Japanese Yen rally. One of my students caught some nice chunks of the recent move lower in USD/JPY, earning 70 pips and 85 pips on successive trades. Way to go, M!

The recent strength in the Japanese Yen created some terrific moves, but we should keep things in perspective - the gains made during the recent move lower in NZD/JPY (New Zealand Dollar/Japanese Yen), GBP/JPY (Great Britain Pound/Japanese Yen), and EUR/JPY (Euro/Japanese Yen) and other Yen pairs are nothing compared to the huge profits earned by long-term traders who were short the Japanese Yen when these pairs were rallying. For a case in point, have a look at the daily chart of NZD/JPY (see figure 1)...