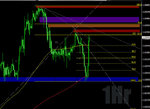

USD GDP figure 20 minutes ago was weaker than expected. So you'd expect EUR/USD to go up. But it went down about 20 pips before going up very sharply 100 pips. Why the fall? Is it that some traders have long positions with very tight stops that all trigger each other so a tiny move in the wrong direction gets compounded?