5th Disciple

Newbie

- Messages

- 0

- Likes

- 0

I originally posted this is in the starting forum, but thought it might be more appropriate here. here's the question, Is it possible to predict the movement of one commodity using another commodity that is closely related, and what is the technical term for this.

For example, Crude and fuel oil. The example I have given below is Iron ore against Steel. Obviously, Iron ore and China Cold rolled plates are not traded on the paper market, but the LME does have a Steel index. Can you use Iron ore to track steel and vice versa?

Graph 1, Indian Iron ore Fines price (01/08/02008- now)

Graph 2, China Cold rolled plate price (01/08/02008- now)

Graph 3, movement almost identical as can be observed when merging both graphs.

Graph 4 of LME Far East Steel Billet Index (01/08/02008- now)

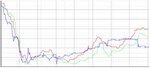

Graph 5, Using the LME Far East Steel index and merging all 3 graphs using exactly the same data range.

Blue = LME Index

Red =Cold Rolled Plate Index

Green = Indian 63.5% Iron ore Fines price

For example, Crude and fuel oil. The example I have given below is Iron ore against Steel. Obviously, Iron ore and China Cold rolled plates are not traded on the paper market, but the LME does have a Steel index. Can you use Iron ore to track steel and vice versa?

Graph 1, Indian Iron ore Fines price (01/08/02008- now)

Graph 2, China Cold rolled plate price (01/08/02008- now)

Graph 3, movement almost identical as can be observed when merging both graphs.

Graph 4 of LME Far East Steel Billet Index (01/08/02008- now)

Graph 5, Using the LME Far East Steel index and merging all 3 graphs using exactly the same data range.

Blue = LME Index

Red =Cold Rolled Plate Index

Green = Indian 63.5% Iron ore Fines price