inakocibelli

Junior member

- Messages

- 16

- Likes

- 0

The fell to the lowest levels in two weeks against the dollar, after Japan’s finance minister warned that Tokyo was prepared to intervene in the foreign exchange market if necessary.

Demand for the dollar was underpinned after New York Federal Reserve President William Dudley said Friday that it was reasonable to expect 2 rate hikes this year, despite data showing the U.S. job growth increased at the slowest rate in 7 months in April.

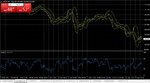

The RSI is located between the number 50 & 70 which indicates a bullish trend, with an important Fibonacci (38.2%) located right at our entry point.

The pair is reaching near supply area on the one hour chart at 108.320, with a stop at 108.000 and first target located at 110.000. At the moment we reach our first target I will take half my profit and continue to target two at 110.750.

Demand for the dollar was underpinned after New York Federal Reserve President William Dudley said Friday that it was reasonable to expect 2 rate hikes this year, despite data showing the U.S. job growth increased at the slowest rate in 7 months in April.

The RSI is located between the number 50 & 70 which indicates a bullish trend, with an important Fibonacci (38.2%) located right at our entry point.

The pair is reaching near supply area on the one hour chart at 108.320, with a stop at 108.000 and first target located at 110.000. At the moment we reach our first target I will take half my profit and continue to target two at 110.750.