marketwavez

Junior member

- Messages

- 27

- Likes

- 0

Here is a thread that is being set up as an atempt to discuss US STOCKS

and possible Elliott Wave-counts---------------------

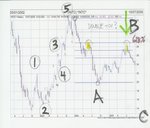

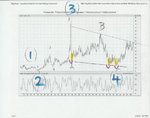

INTEL .... Ticker ( INTC )

.................................................. .................................................. ..

LET'S see .....What do we have here ....

This is one that kinda makes the STOCK World go- round ...

Have had this one on the radar since mid August 05

What a stench this could cause world wide , if only the tech sector was to understand these implications .... a double top has formaed in the longer term charts ... Oh No ! ... Not just any old Double Top we also have a retracement of 618 % for those who watch and understand Fibonacci Retracements ....

Well , I leave the Daily charts posted below for you to go figure ? ..............

Please don't go out and buy or sell this stock because you saw this post ......

Utilize your own trading strategy ,,,, I am just trying to post what I see going on.... That's it ... I am not advising anything .... These are not recomendations ....

-------------------------------------------------------------------------------------------------------------------------

What makes a market place is all of our diffrences of opinions .

------- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

It is far more difficult to Exit a trade than to Enter a trade .... I am sure that you have heard that said before ,,,

THIS IS WHY ,

When making trade it just as important to have an idea where you want to exit as it is to place a stop to protect yourself from a move against you .

( THIS IS A PEARL OF WISDOM )

THERE IS NO HOLY GRAIL ///// I KNOW THAT YOU KNOW THIS ....

THATS WHY I TRADE ELLIOT WAVES , because its giving you a probability of where to look for a turn in a given market .....

The smaller the risk in relation to the price objective , the better chance of success in long haul .... (This is called Risk to Reward )

It’s just the way that is ...

---------------------------------------------------------------------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Attachments

Last edited: