One the many questions traders have once they have learned how to trade is, which market or markets should I trade? While there are many things to consider when making this decision, I wanted to share with you today a market that I consider to be one of my favorites, the Ten Year U.S. Treasury Note (TY) Futures. This is one of the biggest and most important global treasury markets. Interest rates that affect all of our lives from a financial perspective are determined here. In other words, this is the free market for interest rates. There are other bond/treasury markets as well but this is one of the biggest.

This market is attractive for a few reasons. First, the Ten Year U.S. Treasury Note Futures market has tons of volume making it a very liquid market. This means that quality Supply and Demand levels are very solid and easy to identify. Below is a recent short term trade I took in this market; let's have a look.

Figure 1

Notice the Supply level on the 15-minute chart in the Ten Year Futures. Prices were trading sideways in the yellow shaded area. This suggested Supply and Demand were in balance. The truth is, it is never a balanced equation. It simply takes time for this unbalanced equation to play out. When price initially fell from that level, this told us that Supply exceeded Demand in that area shaded yellow. This is the ONLY reason why price fell from that level. These are retail prices at that level and to profit when buying and selling anything, we want to be a seller at retail prices. A short while later, price rallied back up to that supply level which means I sold at retail prices to someone who is trained to buy at retail prices. Anyway, I had to catch a plane to Miami so I treated it as a very short-term trade and walked away with a small profit of $750. More importantly, notice how clear that supply level is, how you can almost draw a box around that level. This is one of the benefits of the Ten Year Treasury Note Futures, a fantastic trading market, if you know how to trade properly.

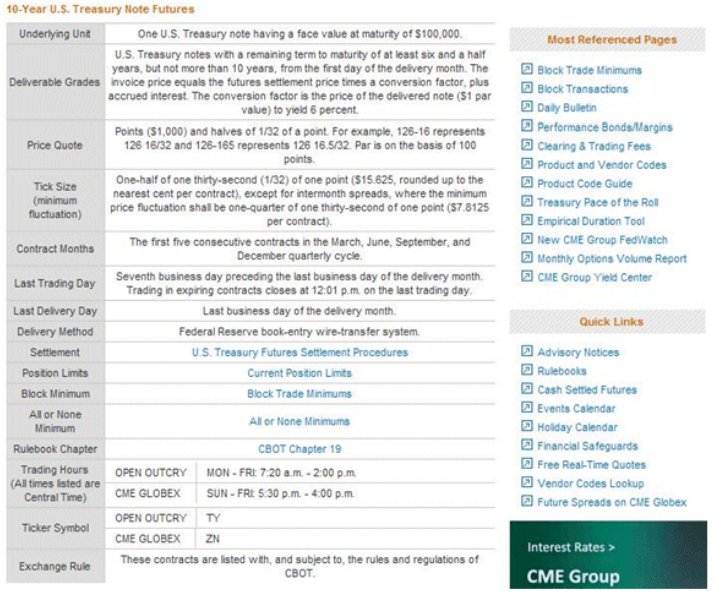

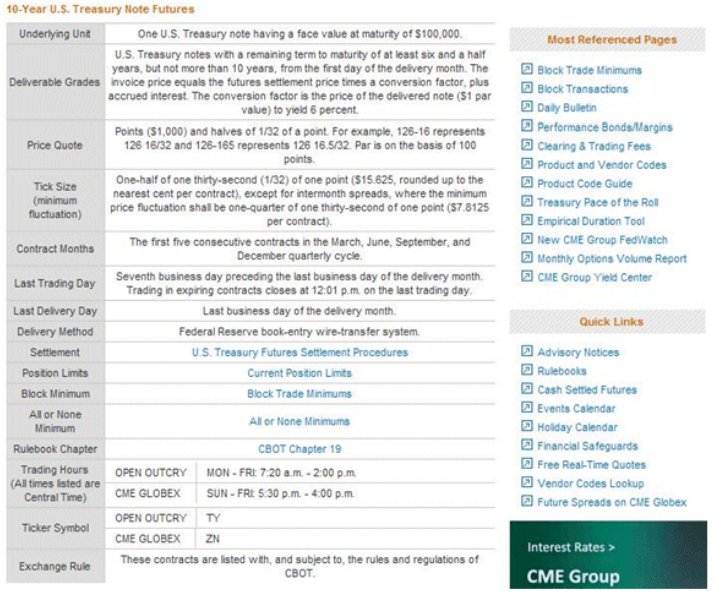

Where can you find more information on this market, you may ask? There is a free source where you can get all the information you need to know about the details of this market. Go to www.cmegroup.com as this is the website for the Chicago Mercantile Exchange, the largest exchange in the world. Find your way to the Interest Rate products and there you will find the Ten Year U.S. Treasury Note Futures. Click on "Contract Specifications" and you will see the information below. Contract specs gives you the important facts such as the value of the contract, expiration months (these are not options), value per tick (how much you will make or lose per tick, per contract, settlement procedures, trading hours, ticker symbol, and more... Make sure you understand that this information tells you everything about how this market operates and trades. The information does NOT tell you where to buy and sell or how to make money trading this or any other market.

Figure 2

Are interest rates a part of your life? Do you ever borrow money or do you have money invested in interest bonds? If so, how would you like to have the ability to forecast where interest rates are going in advance with a very high degree of accuracy? This can have an enormous impact on your life when it comes to finances. Remember, the Ten Year is one of the largest free markets for interest rates. This is where interest rates come from. For those who don't know, when Bond prices go up, interest rates come down. When Bond prices come down, interest rates go up. This is where rates are determined. So, in the example above, by knowing where the real supply (retail price) is, we can time the change in direction in interest rates. When price rallied up to that supply level, price was about to decline, which means interest rates were about to go up. This is key information for someone with an adjustable rate mortgage or someone seeking a high rate of return from bonds. For investors, we would look at supply and demand levels in the larger time frames.

The purpose of this article is to expand your horizons beyond stocks. The markets that truly affect our standard of living are those that are related to interest rates, currency values, and food and energy prices. All these markets are found in the futures. Spend some time on the CME website, all these markets are found there, and then some... I have written other articles that cover learning how to either profit from trading these markets or hedging life's major expenses and you can find out about these through my contact details.

This market is attractive for a few reasons. First, the Ten Year U.S. Treasury Note Futures market has tons of volume making it a very liquid market. This means that quality Supply and Demand levels are very solid and easy to identify. Below is a recent short term trade I took in this market; let's have a look.

Figure 1

Notice the Supply level on the 15-minute chart in the Ten Year Futures. Prices were trading sideways in the yellow shaded area. This suggested Supply and Demand were in balance. The truth is, it is never a balanced equation. It simply takes time for this unbalanced equation to play out. When price initially fell from that level, this told us that Supply exceeded Demand in that area shaded yellow. This is the ONLY reason why price fell from that level. These are retail prices at that level and to profit when buying and selling anything, we want to be a seller at retail prices. A short while later, price rallied back up to that supply level which means I sold at retail prices to someone who is trained to buy at retail prices. Anyway, I had to catch a plane to Miami so I treated it as a very short-term trade and walked away with a small profit of $750. More importantly, notice how clear that supply level is, how you can almost draw a box around that level. This is one of the benefits of the Ten Year Treasury Note Futures, a fantastic trading market, if you know how to trade properly.

Where can you find more information on this market, you may ask? There is a free source where you can get all the information you need to know about the details of this market. Go to www.cmegroup.com as this is the website for the Chicago Mercantile Exchange, the largest exchange in the world. Find your way to the Interest Rate products and there you will find the Ten Year U.S. Treasury Note Futures. Click on "Contract Specifications" and you will see the information below. Contract specs gives you the important facts such as the value of the contract, expiration months (these are not options), value per tick (how much you will make or lose per tick, per contract, settlement procedures, trading hours, ticker symbol, and more... Make sure you understand that this information tells you everything about how this market operates and trades. The information does NOT tell you where to buy and sell or how to make money trading this or any other market.

Figure 2

Are interest rates a part of your life? Do you ever borrow money or do you have money invested in interest bonds? If so, how would you like to have the ability to forecast where interest rates are going in advance with a very high degree of accuracy? This can have an enormous impact on your life when it comes to finances. Remember, the Ten Year is one of the largest free markets for interest rates. This is where interest rates come from. For those who don't know, when Bond prices go up, interest rates come down. When Bond prices come down, interest rates go up. This is where rates are determined. So, in the example above, by knowing where the real supply (retail price) is, we can time the change in direction in interest rates. When price rallied up to that supply level, price was about to decline, which means interest rates were about to go up. This is key information for someone with an adjustable rate mortgage or someone seeking a high rate of return from bonds. For investors, we would look at supply and demand levels in the larger time frames.

The purpose of this article is to expand your horizons beyond stocks. The markets that truly affect our standard of living are those that are related to interest rates, currency values, and food and energy prices. All these markets are found in the futures. Spend some time on the CME website, all these markets are found there, and then some... I have written other articles that cover learning how to either profit from trading these markets or hedging life's major expenses and you can find out about these through my contact details.

Last edited by a moderator: