Lindsaybev

Junior member

- Messages

- 31

- Likes

- 7

Good day. This is my very first attempt at journaling. I just began paper trading the QQQ. I am paper trading so that I can practice trading price by way of Wyckoff's ideas, DBPhoenix's SLAB, in particular. I am starting a journal to learn how to use the ideas in the SLAB, to help form a clear thought process, and learn from my mistakes. At the moment, I am using the Weekly and Daily charts, using the daily to make my trades.

This may be a muddled mess in the beginning. I just hope that others here who are familiar with this way of trading will be willing to instruct me. Thank you for your time.

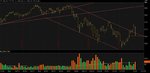

The Weekly chart has a clear downward trajectory. The last price bar which pierces the SL looks as if it may be an area where I will eventually be placing a fanned out SL. So I am thinking "SHORT at the retracement."

Then on the Daily I see the huge gap up, which gave me pause. The run from Nov. 20 - Dec. 3 has been very strong, passing the halfway point and the last swing high, passing the halfway mark of the swing high before that, almost reaching the second-to-last swing high. With volume on the previous swing lows looking climactic, and with price rising on lower volume...maybe I am incorrect? Possibly I should be looking for a LONG....

Then the next day, Dec.4, the price plummets back into the old trend range, stopping just below the midpoint of the last run up, closing a frog's hair above it. And now I am totally confused. With it holding at the halfway point, it suggests that my LONG thought was correct. But price also made a lower high, suggesting my original SHORT thought was correct.

Any advice would be much appreciated! 🤓

-L

My actual journal was thus:

11.30.18

Looking to go SHORT on the QQQ as the channel I have drawn shows that it is in overbought territory. The trend is clearly downward with lower highs and lower lows. I am waiting for a retracement to enter. The trendline has been broken, and I will look to fan it if price passes the last swing low.

I am a bit confused about what is "overbought territory" (AMD theory that price will revert back to the mean of its channel) and what constitutes a real change in trend.

12.3.18

I think I may have made a mistake, as the price is way above the halfway point from the last swing low, suggesting strength not weakness. Today price pierced upward very forcefully. Maybe I should be looking for a LONG on a pullback? I also note that the low points on the prior swing lows have had huge volume, suggesting climaxing out, while the up-moves have been in much lower volume, suggesting that it is not taking much to move the price upward.

But kind of in a quandary, as the price is way above the halfway point, suggesting strength, but it is also above the channel top line, which is the overbought area.

12.4.18

Went SHORT 100 on QQQ @ 169.26, when price passed the low of yesterday's bar. It was a good solid down day, back into the trend, with another lower high.

BUT...the price stopped at almost the exact halfway point. This is a healthy pullback, no? Could this down day have just been a natural pullback from such a stong run up?

This may be a muddled mess in the beginning. I just hope that others here who are familiar with this way of trading will be willing to instruct me. Thank you for your time.

The Weekly chart has a clear downward trajectory. The last price bar which pierces the SL looks as if it may be an area where I will eventually be placing a fanned out SL. So I am thinking "SHORT at the retracement."

Then on the Daily I see the huge gap up, which gave me pause. The run from Nov. 20 - Dec. 3 has been very strong, passing the halfway point and the last swing high, passing the halfway mark of the swing high before that, almost reaching the second-to-last swing high. With volume on the previous swing lows looking climactic, and with price rising on lower volume...maybe I am incorrect? Possibly I should be looking for a LONG....

Then the next day, Dec.4, the price plummets back into the old trend range, stopping just below the midpoint of the last run up, closing a frog's hair above it. And now I am totally confused. With it holding at the halfway point, it suggests that my LONG thought was correct. But price also made a lower high, suggesting my original SHORT thought was correct.

Any advice would be much appreciated! 🤓

-L

My actual journal was thus:

11.30.18

Looking to go SHORT on the QQQ as the channel I have drawn shows that it is in overbought territory. The trend is clearly downward with lower highs and lower lows. I am waiting for a retracement to enter. The trendline has been broken, and I will look to fan it if price passes the last swing low.

I am a bit confused about what is "overbought territory" (AMD theory that price will revert back to the mean of its channel) and what constitutes a real change in trend.

12.3.18

I think I may have made a mistake, as the price is way above the halfway point from the last swing low, suggesting strength not weakness. Today price pierced upward very forcefully. Maybe I should be looking for a LONG on a pullback? I also note that the low points on the prior swing lows have had huge volume, suggesting climaxing out, while the up-moves have been in much lower volume, suggesting that it is not taking much to move the price upward.

But kind of in a quandary, as the price is way above the halfway point, suggesting strength, but it is also above the channel top line, which is the overbought area.

12.4.18

Went SHORT 100 on QQQ @ 169.26, when price passed the low of yesterday's bar. It was a good solid down day, back into the trend, with another lower high.

BUT...the price stopped at almost the exact halfway point. This is a healthy pullback, no? Could this down day have just been a natural pullback from such a stong run up?

Last edited: