Hello,

I am new to spread trading, but not futures markets.

Been trading the Futures markets for a little while with success, but became interested in Spread Trading.

In the past I have done some Spread Trading in the Stock Options market (Credit Spreads mainly).

Right now I am wondering if anyone has advise on what to look for for an entry point into a futures Calendar Spread.

What is your trigger on a spread chart, do you look for a bounce off the low, as in any other market, or is it that simple.

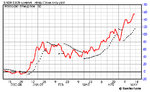

On the attached image, are we looking for an entry with the lowest Neg number? (mid April)

Thanks for your input.

Example: June09 Crude - Aug09 Crude:

I am new to spread trading, but not futures markets.

Been trading the Futures markets for a little while with success, but became interested in Spread Trading.

In the past I have done some Spread Trading in the Stock Options market (Credit Spreads mainly).

Right now I am wondering if anyone has advise on what to look for for an entry point into a futures Calendar Spread.

What is your trigger on a spread chart, do you look for a bounce off the low, as in any other market, or is it that simple.

On the attached image, are we looking for an entry with the lowest Neg number? (mid April)

Thanks for your input.

Example: June09 Crude - Aug09 Crude: