Here we go again...

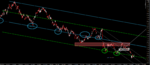

This time we have complications in the mix with brexit but nonetheless we have a developing framework for rate increases with inflation forecast to be 2.7% by the end of 2017. The data in the uk has shown to be resilient and we have seen a huge depreciation in sterling which opens up opportunity. As ever timing is going to need to be ballpark but doesn't need to be precise and pairing this trade (long sterling) is going to be key to avoid high rollover costs on holding time. I have yet to do analysis on pairing but will do that over the course of this month. So here is a heads up for another long term trade in planning.

This time we have complications in the mix with brexit but nonetheless we have a developing framework for rate increases with inflation forecast to be 2.7% by the end of 2017. The data in the uk has shown to be resilient and we have seen a huge depreciation in sterling which opens up opportunity. As ever timing is going to need to be ballpark but doesn't need to be precise and pairing this trade (long sterling) is going to be key to avoid high rollover costs on holding time. I have yet to do analysis on pairing but will do that over the course of this month. So here is a heads up for another long term trade in planning.