Hello everyone!

Before I dive into the depth of my trade, I just want to give you some of my background.

Around February 2016 I began to look into the stock market for the first time in my life. I decided to take the plunge after realizing what a valuable asset only I had when it came to trading. It wasn't books, magazines, or courses. It was experience!

My father swing traded for 20 years to help him reach retirement. He still trades now as a hobby even though he is retired. I live with him every day. What a mentor I had!

Being so young at the time, only 15, I decided that then was the best time to start. I raked up my life savings, a meager few thousand. It was all I saved from birthday gifts, family holidays, and Christmas over the course of my life. I never had a job nor any allowance, so getting money was nearly impossible.

I didn't know where to start, so I asked my father.

Me: "How can I start trading?'

Him, "Start with a paper trading."

Me: "Sounds good, but can I copy your strategy?"

Him: "Unfortunately, for you to do so, you would need to quit school."(It was a 9-5 strategy)

He realized I was still in high school so I would be very busy. So he suggested a strategy that I could do while going to school: seasonal investing!!!

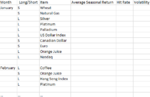

My father printed me charts from http://www.mrci.com/client/spmarket/ to start analyzing.

And that's the beginning of my seasonal trading journey.

Do you guys want to here more of my story of learning how to trade before I get to the trades? Or should I just skip to the trades?

Before I dive into the depth of my trade, I just want to give you some of my background.

Around February 2016 I began to look into the stock market for the first time in my life. I decided to take the plunge after realizing what a valuable asset only I had when it came to trading. It wasn't books, magazines, or courses. It was experience!

My father swing traded for 20 years to help him reach retirement. He still trades now as a hobby even though he is retired. I live with him every day. What a mentor I had!

Being so young at the time, only 15, I decided that then was the best time to start. I raked up my life savings, a meager few thousand. It was all I saved from birthday gifts, family holidays, and Christmas over the course of my life. I never had a job nor any allowance, so getting money was nearly impossible.

I didn't know where to start, so I asked my father.

Me: "How can I start trading?'

Him, "Start with a paper trading."

Me: "Sounds good, but can I copy your strategy?"

Him: "Unfortunately, for you to do so, you would need to quit school."(It was a 9-5 strategy)

He realized I was still in high school so I would be very busy. So he suggested a strategy that I could do while going to school: seasonal investing!!!

My father printed me charts from http://www.mrci.com/client/spmarket/ to start analyzing.

And that's the beginning of my seasonal trading journey.

Do you guys want to here more of my story of learning how to trade before I get to the trades? Or should I just skip to the trades?

Last edited: