You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yes, they do this all the time. I'm assuming this was a news event btw?

yes it was.....but 45 pips? Closed the account and I will report them to ASX in the morning or the appropriate body.

:-0

:-0 F@CK what was the time this happened? What's the instrument?

Oanda is known as a market maker, probably they felt insecure about the feed they got from Prime and decided to reassure they won't let somebody to earn at their expenses 😀

Be careful guys

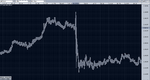

The perfect trade, but Oanda widens the spread to 45 pips and takes me out and goes in my direction

Deep frustration.

Did you encounter similar experience?

:-0 F@CK what was the time this happened? What's the instrument?

Oanda is known as a market maker, probably they felt insecure about the feed they got from Prime and decided to reassure they won't let somebody to earn at their expenses 😀

Be careful guys

:-0

:-0 f@ck what was the time this happened? What's the instrument?

Oanda is known as a market maker, probably they felt insecure about the feed they got from prime and decided to reassure they won't let somebody to earn at their expenses :d

be careful guys

gu

Why u r so surprised thats always been the case with Oanda and it can go higher than that ....

they should not be allowed to do this.....I knew they were bad but not this bad, anyway it is done now.....it is just not nice to be right and get trapped by your broker....

itspossible

Senior member

- Messages

- 2,796

- Likes

- 570

so did the spread take your stop out m8.how much did you lose

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

yes it was.....but 45 pips? Closed the account and I will report them to ASX in the morning or the appropriate body.

Oanda had some of the worst spreads to begin with. I would look at Interactive Brokers. I am charged 0.3 pips EUR/USD, 0.5 pips GBP/USD, 0.1 pips USD/JPY,0.5 pips NZD/USD, 0.6 pips AUD/USD, max 6 pips USD/DKK.

so did the spread take your stop out m8.how much did you lose

Just a bit more than a normal loss, but that is not the point, I felt robbed, I can understand a broker to widen the spread during the news, 2,3 or 5 pips? But 45 pips is crazy.

It is not about the money, I felt it was my responsibility to open this thread as a community member so other can be choose to be robbed if they like.

Oanda had some of the worst spreads to begin with. I would look at Interactive Brokers. I am charged 0.3 pips EUR/USD, 0.5 pips GBP/USD, 0.1 pips USD/JPY,0.5 pips NZD/USD, 0.6 pips AUD/USD, max 6 pips USD/DKK.

Yes IB are good, I have also account with ICM and Pepperstone, they are very good.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

The perfect trade, but Oanda widens the spread to 45 pips and takes me out and goes in my direction😢

Deep frustration.

Fug, were you really scammed?

A quick look at Onadas site brings you here

According to Onadas data the spread went 35

Zooming out we can see that 20+ is common

Is it fair? Well, If you pull up a 6B order book next news time, and watch how thin things get. You can judge for yourself.

Were you robbed? Not really imo. Its just another example of 'right yet wrong trading'.

You were 'right' on the direction but 'wrong' on the result.

Ask yourself how. How were you 'right' on the direction yet 'wrong' on the result? It hasnt got much to do with the broker imo...

Its an opportunity to learn mate. Whatcha gona do with it?

Pat Riley

Established member

- Messages

- 794

- Likes

- 178

Retail brokers will cover their liquidity volatility by widening their spreads. You know in advance they're goin ta do that. OANDA appear to even tell you by how much too.

If you're trading intraday positions (i.e relatively small stops) then simply don't be in a trade when a pair is likely to get hit with a spread. It's a 50/50 punt at best on news releases and with the brokers free lunch on the spread you're already behind the edge.

If you're position or swing trading then 45 pips isn't goin ta be much of an issue for ya, just a ripple on the pond.

If you're trading intraday positions (i.e relatively small stops) then simply don't be in a trade when a pair is likely to get hit with a spread. It's a 50/50 punt at best on news releases and with the brokers free lunch on the spread you're already behind the edge.

If you're position or swing trading then 45 pips isn't goin ta be much of an issue for ya, just a ripple on the pond.

Fug, were you really scammed?

A quick look at Onadas site brings you here

According to Onadas data the spread went 35

Zooming out we can see that 20+ is common

Is it fair? Well, If you pull up a 6B order book next news time, and watch how thin things get. You can judge for yourself.

Were you robbed? Not really imo. Its just another example of 'right yet wrong trading'.

You were 'right' on the direction but 'wrong' on the result.

Ask yourself how. How were you 'right' on the direction yet 'wrong' on the result? It hasnt got much to do with the broker imo...

Its an opportunity to learn mate. Whatcha gona do with it?

If you go to the min/max chart the bid shows 1.5635 and the ask 1.5680 at the time, that is 45 pips spread and if it was only 35 it would be still a big scam in my opinion.

We pay spread on the base that they supply liquidity, if they are not able to supply liquidity they should do something else.

Yes I feel I have been robed because with another of my broker prices never got to my stop loss and I would have made good money on that trade.

My wrong doing was to take that trade with Oanda. Which is never going to happen again. Yes, lesson leant.

What I am going do about it? Already did, took all my money out of the account.🙂

Attachments

Last edited:

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Fug, thats a 1 min chart. If you have tick data that shows more than 35 wide you can have at them no?If you go to the min/max chart the bid shows 1.5635 and the ask 1.5680 at the time, that is 45 pips spread and if it was only 35 it would be still a big scam in my opinion.

Well, id say we pay spread through a dealer because we cant offer in their market, they can price as they see fit. If the UM / their LPs show 35 wide, then why should they give you less? In their position, would you? (apart from to the true B bookers, bless em, give em whatever they want 😍)We pay spread on the base that they supply liquidity, if they are not able to supply liquidity they should do something else.

Yes I feel I have been robed because with another of my broker prices never got to my stop loss and I would have made good money on that trade.

If you had the same play in 6B and got stopped out the same way when the spread went 35, would you still feel as though youd been robbed?

Heres where I think youve not done so well:-My wrong doing was to take that trade with Oanda. Which is never going to happen again. Yes, lesson leant.

What I am going do about it? Already did, took all my money out of the account.🙂

1) Onada show on their website that their GU spreads routinely go 20+ (as high as 40), most often around news (and I guess overnight).

2) You were either unaware of this info or thought it unimportant.

3) Then knowingly / or not, of the above, you chose to trade around news with a stop order (the perfect order to capture such a spread move)

4) You allow you beliefs to blot out 'what is' and express this by concluding that you were robbed and by closing youre account.

Im sure theres more, I know Ive done as youve done (and far worse 😆) in the same position.:clover:

As far as your other broker not widening their spreads so much. Thats fine but it doesnt mean they wont next time, perhaps they were using different LPs.

Also, if your strat relies on generous fills to be profitable, then in my experience at least, those fills will start to get more 'realistic', as soon as the dealer realises youre anything more than B book.

Fug, thats a 1 min chart. If you have tick data that shows more than 35 wide you can have at them no?

Well, id say we pay spread through a dealer because we cant offer in their market, they can price as they see fit. If the UM / their LPs show 35 wide, then why should they give you less? In their position, would you? (apart from to the true B bookers, bless em, give em whatever they want 😍)

If you had the same play in 6B and got stopped out the same way when the spread went 35, would you still feel as though youd been robbed?

Heres where I think youve not done so well:-

1) Onada show on their website that their GU spreads routinely go 20+ (as high as 40), most often around news (and I guess overnight).

2) You were either unaware of this info or thought it unimportant.

3) Then knowingly / or not, of the above, you chose to trade around news with a stop order (the perfect order to capture such a spread move)

4) You allow you beliefs to blot out 'what is' and express this by concluding that you were robbed and by closing youre account.

Im sure theres more, I know Ive done as youve done (and far worse 😆) in the same position.:clover:

As far as your other broker not widening their spreads so much. Thats fine but it doesnt mean they wont next time, perhaps they were using different LPs.

Also, if your strat relies on generous fills to be profitable, then in my experience at least, those fills will start to get more 'realistic', as soon as the dealer realises youre anything more than B book.

I do not understand your post, seems like you want turn this is one of your endless conversation.......

I am showing my experience to the community, the spread was 45 pips and it clearly shows in the ask/bid charts, which I personally consider inappropriate, my stop loss was not close, it was based on the extreme of the 30m charts as showed in my first chart.

If you think having a spread of 35-45 pips is ok for you then trade with them, that is fine with me, I do not care.

For what I am concerned I have done my job, I have informed others what can happen to them (seems many already knew), now they can make they own decision.

GL.

Last edited:

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

I know mate, one day you might.I do not understand your post, seems like you want turn this is one of your endless conversation.......

I am showing my experience to the community, the spread was 45 pips and it clearly shows in the ask/bid charts, which I personally consider inappropriate, my stop loss was not close, it was based on the extreme of the 30m charts as showed in my first chart.

If you think having a spread of 35-45 pips is ok for you then trade with them, that is fine with me, I do not care.

For what I am concerned I have done my job, I have informed others what can happen to them (seems many already knew), now they can make they own decision.

GL.

Will keep an eye out for the next 'whack whack I been scammed' thread. They are 2 a penny on T2W.

All the best

D