Today when i launvhed my tradingdesk whe started with risk averse session . My long from overnight was stopped out.

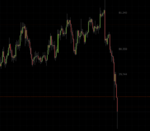

The first position i entered was a short in the gbp/chf because of the none movement to any stabilization in any pairs and the sell off contineud the gbp/chf was still in a range i entered 1 short before the cpi nrs. The outcome was bad for the uk what let me short another 1 cpi out come was -0.1% from -0,2%.

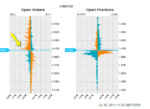

Then i saw there was a huge option barrier with stops between the 79.50 handle i should have traded the hunt but instead i traded the pullback after the clearing. (usd/jpy

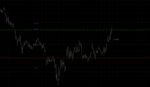

Then the rumours came when euro came close to the 1.38 handle that ecb was buying Italian bonds and also the some Assian names where envolved that rumour + the huge contraction and support let me pull the trigger for a eu long. (eur/usd)

gbp/chf 2 in tottal - 1 closed @26 pips.

Risk 2% - 1 closed @ 77pips.

Tottal: 103.

Usd/jpy closed bit to late 1

Risk 1% 1 @21 pips.

Eur/usd still open WIll be managed

Risk2%

Tottal 124 pips with 1 still open the eur/usd.

For now looks like risk is off a bit my main trigger for the eu entry where the bonds.

Here a quick summary behind the eurozone current situation.

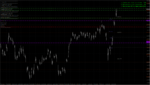

It has been another rollercoaster ride in the financial markets this morning with European investors taking currencies and equities sharply lower when London markets opened for trading. However as the European session progressed and European officials provided assurance to the market that they are working hard at preventing a default by any Eurozone nation, currencies and equities started to recover its earlier losses. The focus remains squarely on Europe and there are a few factors behind today's intraday rebound in the euro. Whether the bounce can be sustained remains to be seen but there is no question that everything hinges upon confidence because every pip move in the EUR/USD has been determined by rumors and news headlines.

Here are the 5 Factors Behind the Intraday Rebound in the EUR

1. EU Leaders Schedule a Special Summit on EZ Debt Crisis

EU leaders are working hard at stabilizing the financial markets, holding meetings after meetings and on Friday they will hold a special summit to discuss the debt crisis. As we have seen in the recent price action of the euro, all talk and no action is not enough to stabilize sentiment but at bare minimum, it proves that European officials are not asleep at the wheel and ignoring the situation.

2. Eurogroup Takes Steps to Provide Funding Relief for Greece

After the 2 day Eurogroup meeting on Greece, we finally have some concrete actions that will provide much needed debt relief for Greece. Eurogroup nations have agreed to enhance the flexibility and the scope of the EFSF, lengthening the maturities of the loans and lowering the interest rates. The group also discussed main parameters of a new multi-annual adjustment programme for Greece that could improve sustainability of Greek debt. Although private sector involvement and rating agency approval remains a challenge, these are all steps in the right direction.

3. Italy Accelerates Fiscal Package Vote

Italy knows that they could be the next domino to fall which is why Italian officials are looking for ways to boost investor confidence. One of those ways is to accelerate a fiscal package vote. Originally the vote was scheduled for the beginning of August, but it could now take place within the next 2 weeks. Unlike Greece, the opposition party does not have significant issues with the fiscal package. Only a few amendments are expected and the package should pass smoothly which would help to bolster confidence.

4. Comments from Luxembourg Finance Minister

The euro also received some help from the Luxembourg Finance Minister who said there will be no country defaulting in the Eurozone. With Greek and Italian credit default swap spreads remaining at very high levels, we question the accuracy but in a market where investors are hanging on every word from European officials, Frieden's confidence was enough to boost the euro.

5. ECB Buying Italian Bonds?

There was also a rumor that the ECB could be buying Italian bonds - this is completely unsubstantiated but still managed to contribute to the rebound in the currency.

Finally the U.S. dollar came under pressure after the U.S. trade numbers showed the trade deficit expanding from -$43.6B to -$50.2B to its largest level since October 2008. The expansion in the trade gap was caused largely by a surge in oil imports but exports also dropped 0.5 percent. with retail sales weakening in the second quarter, if the trade balance remains at current levels in June, we could be looking at much slower GDP growth in Q2.

Source (kathy lien).

I am holding my euro position reason is if thing will clear more up i have a nice swing trade entryprice is 1.3887 i keep eyes on the 1.3950.

I have no intension to open new trades anymore today will see later on the day what plan i have.