Profitsniper007

Active member

- Messages

- 107

- Likes

- 2

These are long term trades, taken from D1 - M1 charts.

Stop losses will be big, but with good ratios to profit targets.

Trade at your own risk and make sure you are cautious with your lot sizes.

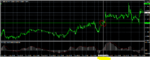

USD/SEK

Pattern Bearish Gartly

Time Frame - Weekly.

I am taking this trade now, sell 6.5528

SL 6.654 (1000 pips)

TP 6.6500 (3000 pips)

Stop losses will be big, but with good ratios to profit targets.

Trade at your own risk and make sure you are cautious with your lot sizes.

USD/SEK

Pattern Bearish Gartly

Time Frame - Weekly.

I am taking this trade now, sell 6.5528

SL 6.654 (1000 pips)

TP 6.6500 (3000 pips)

Last edited: