Nowler

Experienced member

- Messages

- 1,551

- Likes

- 223

Hi,

Was just doing a bit of pondering today... looking at the major currencies, and it got me wondering.

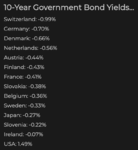

Isn't the EU being at 0.0% interest rates a major concern?

We are clearly in a period of global economic slow down, and likely heading into a recession at some point in the near future.

When this happens, the 2 main tools an economy has to navigate through are 1) QE, and 2) Lowering interest rates.

Looking at the USD and CAD, their interest rates are at 2.5 and 1.75 respectively.

With their current level of inflation being 2.0 each.

Neither is struggling with high inflation, and have room to breathe should it increase a bit.

But looking at the EUR, the interest rates are at 0, granted they also have room to breathe should inflation rise when they start printing more money to stimulate their economy.

This puts the likes of the USD, CAD, AUD, NZD in pole position when trading against the EUR when a recession does hit. As each of these have 2 tools to tackle a contracting economy.

Anyone got any thoughts on this?

Am I making any errors in my thinking perhaps?

PS:

Looking at the CHF and the JPY too, they are both currently at negative interest rates. Granted they have more room to breathe in the event of increasing inflation as a result of QE. Wouldn't this make both of them more vulnerable than the EUR in the event of a global recession?

Was just doing a bit of pondering today... looking at the major currencies, and it got me wondering.

Isn't the EU being at 0.0% interest rates a major concern?

We are clearly in a period of global economic slow down, and likely heading into a recession at some point in the near future.

When this happens, the 2 main tools an economy has to navigate through are 1) QE, and 2) Lowering interest rates.

Looking at the USD and CAD, their interest rates are at 2.5 and 1.75 respectively.

With their current level of inflation being 2.0 each.

Neither is struggling with high inflation, and have room to breathe should it increase a bit.

But looking at the EUR, the interest rates are at 0, granted they also have room to breathe should inflation rise when they start printing more money to stimulate their economy.

This puts the likes of the USD, CAD, AUD, NZD in pole position when trading against the EUR when a recession does hit. As each of these have 2 tools to tackle a contracting economy.

Anyone got any thoughts on this?

Am I making any errors in my thinking perhaps?

PS:

Looking at the CHF and the JPY too, they are both currently at negative interest rates. Granted they have more room to breathe in the event of increasing inflation as a result of QE. Wouldn't this make both of them more vulnerable than the EUR in the event of a global recession?