In addition to assets under management, Google Trends shows a steadily rising interest in ‘impact investing’ over the past decade among its searchers.

Let’s take a look at impact investing, how it has evolved over time, and how individuals can implement their own strategy with listed securities.

What Is Impact Investing?

Impact investments are investments designed to generate positive, measurable, social and environmental impact along with a financial return. For example, you might purchase a bond issued by a Community Development Financial Institution (CDFI) that lends to underserved communities.

The GIIN defines four characteristics of impact investments:

- Intentionality: Investors must have an intention to have a positive social or environmental impact through investments.

- Expectations of a Return: Impact investments are expected to generate a financial return on capital or at least a return of capital.

- Flexibility of Returns: Impact investments have a range of returns, from below market to risk-adjusted market rate of returns.

- Measurement of Impact: Investors must measure the social and environmental performance and progress of impact investments over time.

Of course, these characteristics are vague. For instance, there’s little doubt that purchasing a bond issued by a CDFI qualifies as an impact investment, but what about investing in an oil company that has an equal representation of women on its board of directors? Or, investing in a tech company that offsets its emissions with carbon credits?

Investing in listed equities that adhere to high Environmental, Social, and Governance (ESG) standards does not necessarily fullfill the GIIN’s requirement of intentionality in making an impact.

Furthermore, these investments don’t necessarily finance ESG projects that wouldn’t have otherwise been financed—what impact investors call additionality.

How Investors Measure Impact

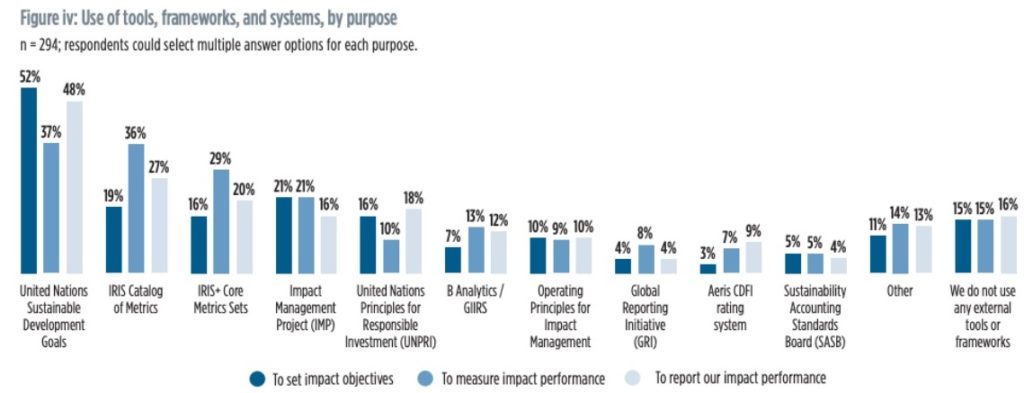

Source: Global Impact Investing Network

In practice, there are many different public frameworks for measuring impact investments, from the UN’s Sustainable Development Goals to the Sustainability Accounting Standards Board. These different frameworks can be used to set objectives, measure performance or report on performance. The chart above shows the breakdown with each framework.

Evolution of Impact Investing

Impact investments were historically limited to high-net-worth and institutional investors through private equity funds and venture capital. By making investments in private and illiquid companies and projects, these funds can easily claim their investments are intentional and additional, while measuring the tangible impact on ESG goals.

The rise of impact funds made it easier for individual retail investors to diversify into impact investments. For instance, the Calvert Impact Capital Community Investment Note is a fixed income product with various CUSIPs available while CNote offers fixed income products ranging from products with flexible quarterly liquidity to fully-insured accounts.

Actively managed ESG mutual funds enable investors to be intentional with their impact investments. For example, the Vanguard Global ESG Select Stock Fund Investor Shares (VEIGX) engages with management teams and votes proxies to encourage companies to adopt and meet ESG goals, above and beyond what passively managed ESG funds do.

That said, passively managed funds can also have a significant impact. Public equities provide an exit for private enterprises pursuing impact, supply the capital needed for impact companies to grow, increase visibility for undervalued impact companies, and democratize access to impact investing by providing the easiest way for retail investors to participate.

How to Build Your Own Portfolio

Investors who want to build their own portfolios may individually select equities that promote ESG goals and actively vote their proxies in the same way as an actively managed fund, invest in actively managed ESG mutual funds, and/or purchase fixed income products that directly finance ESG projects across both government and corporate issuers.

Examples of ESG-friendly equities include:

- TerraForm Power Inc. (TERP) – TerraForm produces wind and solar power that offset 4.1 million metric tons of CO2 in 2019 while simultaneously adopting a Board Diversity policy and ensuring high working standards for its employees.

- Johnson Controls International Plc (JCI) – Johnson Controls produces energy management products and services for businesses and has put sustainability first for years by reducing its energy intensity and aligning efforts with UN SDG goals.

- Xylem Inc. (XYL) – Xylem provides freshwater solutions ranging from pumps to purification. With its comprehensive sustainability strategy, the company targets everything from employee well-being to promoting water reuse.

Investors can also choose to hold ESG exchange-traded funds (ETFs) and mutual funds to align their beliefs with their financial interests. While these investments may not necessarily meet strict impact investing standards, the additional liquidity for ESG-friendly companies could encourage more companies to adopt these standards over time.

In Summary

The rise of ESG ETFs and mutual funds make it seem trivial to add impact investments to your portfolio, but many of these investments lack intentionality and additionality. Fortunately, there are many organizations developing financial products to help retail investors meet these goals and make a greater positive impact on the world.

Justin Kuepper can be contacted at Internationalinvest