coolTrader

Established member

- Messages

- 610

- Likes

- 6

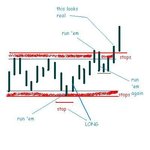

For those who trade breakouts, how do you trade breakouts successfully?

Do you just put a limit order so when it hits breaks out you are in?

Do you wait for it to breakout and pull back and confirm breakout?

If you have tried various methods on average which is the most successful

Lets here your opinion?

Do you just put a limit order so when it hits breaks out you are in?

Do you wait for it to breakout and pull back and confirm breakout?

If you have tried various methods on average which is the most successful

Lets here your opinion?