Profitsniper007

Active member

- Messages

- 107

- Likes

- 2

I am quite surprised no one has already posted about this (when I searched the title name there were no results.)

This is a 222 Gartly Pattern which was first found (or at least made public) by Gartly and was on page 222 of his book - hence the uncreative name.

It is a strong reversal pattern that is successful about 60-70% of the time, some sources say as much as 90% but in my personal experience trading them, I have found 70% to be a fair representation.

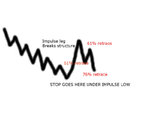

The patterns consists of 4 moves.

First is a impulse leg breaking previous high/lows.

Second is a 61% retrace.

Third is a 61% retrace of that move.

Forth is a 76% retrace of impulse leg.

This is where the buy area is (in a bullish gartly).

Stop loss goes under the impulse leg low.

Targets can be taken in a few ways depending on how long you want to stay in the market. The "safe" way is to target the 38% retrace of the most recent move down and then the 61% of that same move.

You can stay in and target the high of the impulse leg or even higher.

I have attached a drawn (badly) version and I have also attached a real chart example that I am currently trading.

(In the real chart one I have moved my stops since there was the NFP and I felt that if it got high enough to trigger my stops where they are, it would get high enough to take out my original stop loss.)

This is a 222 Gartly Pattern which was first found (or at least made public) by Gartly and was on page 222 of his book - hence the uncreative name.

It is a strong reversal pattern that is successful about 60-70% of the time, some sources say as much as 90% but in my personal experience trading them, I have found 70% to be a fair representation.

The patterns consists of 4 moves.

First is a impulse leg breaking previous high/lows.

Second is a 61% retrace.

Third is a 61% retrace of that move.

Forth is a 76% retrace of impulse leg.

This is where the buy area is (in a bullish gartly).

Stop loss goes under the impulse leg low.

Targets can be taken in a few ways depending on how long you want to stay in the market. The "safe" way is to target the 38% retrace of the most recent move down and then the 61% of that same move.

You can stay in and target the high of the impulse leg or even higher.

I have attached a drawn (badly) version and I have also attached a real chart example that I am currently trading.

(In the real chart one I have moved my stops since there was the NFP and I felt that if it got high enough to trigger my stops where they are, it would get high enough to take out my original stop loss.)