Hello everyone,

I want to share with the community my experience of picking stocks based on the Black Swan concept. I am sure most of you are already familiar with the title and must have heard of Nassim Nicholas Taleb, the author of the book "The Black Swan - The Impact of the highly improbable". I must say Mr Taleb is one of the sharpest thinkers of our age and his thoughts helped shape my trading mentality.

I will not go for long about the idea of the black swan, but I will elaborate it in the trading context:

Black Swans hit the companies that belong to Extremistan (the land of the extremes: the extremely big and the extremely small)

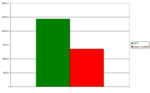

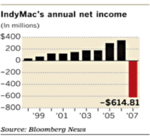

Negative black swans hit the relatively big companies that belong to Extremistan: their history will be constituted of numerous small gains followed by a massive loss that wipes all their gains accumulated. (attachment: negative_black_swan.png is an example)

Positive black swans hit the relatively small companies that belong to Extremistan: their history will be constituted of numerous small losses followed by a huge profit that will cover all the losses accumulated. (attachment: stocks_evolution.png is an example which is my own portfolio)

You may notice that they are opposite situations.

My portfolio:

Between Mai and June 2010 I have picked tens of cheap stocks on Investopedia's Simulator ( they were priced under $10), my expectations were the following:

There will be many loosing companies, possibly most of them will be losers.

There will be few winners that will cover all the losses accumulated and make extra profits.

Now, one year later the portfolio behaved as I expected (as of June 13 2011):

Out of 60 stocks 32 were losers (53%), including 2 companies that went bust.

The overall lost amount is around 136K.

One company and only one company made over 244k, not only it did cover all the losses accumulated it made on it's own over 108k in net profits, the company is Insmed Inc (NASDQ:INSM).

The overall won amount is 379k. The net growth of the portfolio is over 35%.

See attached graphics.

About Insmed: it is a biopharmaceutical company specializing in some sort of protein development, I bought that stock for the following reasons:

1. It is a development company, which is basically on the edge of Black Swans: researchers and scientists are among the first to cause big and massive changes in the world. Also Protein development is an open field in which we never what they might make, so we are open and ready for big positive changes (positive Black Swans).

2. Proteins are very much needed in the Biopharma sector, I don't need to tell you it is one big sector.

Statistical anomalies:

If you pick randomly a large set of penny stocks chances are there will be few companies that will randomly rise and make big growth that might cover all the losses accumulated, so is my portfolio just like that case ?

No, because:

1. The set of my picks isn't very large: only a few tens of stocks.

2. My picks aren't random.

I already know that the Black Swan's concept is often misunderstood or not understood at all. I am already familiar with some of the common comments but it won't stop me from opening the discussion and being open to your comments.

I want to share with the community my experience of picking stocks based on the Black Swan concept. I am sure most of you are already familiar with the title and must have heard of Nassim Nicholas Taleb, the author of the book "The Black Swan - The Impact of the highly improbable". I must say Mr Taleb is one of the sharpest thinkers of our age and his thoughts helped shape my trading mentality.

I will not go for long about the idea of the black swan, but I will elaborate it in the trading context:

Black Swans hit the companies that belong to Extremistan (the land of the extremes: the extremely big and the extremely small)

Negative black swans hit the relatively big companies that belong to Extremistan: their history will be constituted of numerous small gains followed by a massive loss that wipes all their gains accumulated. (attachment: negative_black_swan.png is an example)

Positive black swans hit the relatively small companies that belong to Extremistan: their history will be constituted of numerous small losses followed by a huge profit that will cover all the losses accumulated. (attachment: stocks_evolution.png is an example which is my own portfolio)

You may notice that they are opposite situations.

My portfolio:

Between Mai and June 2010 I have picked tens of cheap stocks on Investopedia's Simulator ( they were priced under $10), my expectations were the following:

There will be many loosing companies, possibly most of them will be losers.

There will be few winners that will cover all the losses accumulated and make extra profits.

Now, one year later the portfolio behaved as I expected (as of June 13 2011):

Out of 60 stocks 32 were losers (53%), including 2 companies that went bust.

The overall lost amount is around 136K.

One company and only one company made over 244k, not only it did cover all the losses accumulated it made on it's own over 108k in net profits, the company is Insmed Inc (NASDQ:INSM).

The overall won amount is 379k. The net growth of the portfolio is over 35%.

See attached graphics.

About Insmed: it is a biopharmaceutical company specializing in some sort of protein development, I bought that stock for the following reasons:

1. It is a development company, which is basically on the edge of Black Swans: researchers and scientists are among the first to cause big and massive changes in the world. Also Protein development is an open field in which we never what they might make, so we are open and ready for big positive changes (positive Black Swans).

2. Proteins are very much needed in the Biopharma sector, I don't need to tell you it is one big sector.

Statistical anomalies:

If you pick randomly a large set of penny stocks chances are there will be few companies that will randomly rise and make big growth that might cover all the losses accumulated, so is my portfolio just like that case ?

No, because:

1. The set of my picks isn't very large: only a few tens of stocks.

2. My picks aren't random.

I already know that the Black Swan's concept is often misunderstood or not understood at all. I am already familiar with some of the common comments but it won't stop me from opening the discussion and being open to your comments.

Attachments

Last edited by a moderator: