The Baptist

Established member

- Messages

- 715

- Likes

- 45

Hi Friends,

Following landing the big Macro Trade of Gold from $962 to $1300 2 months early, I am having a stab at a new long term set up.

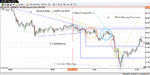

I have Highlighted the recent Break in the AUDUSD – The target is through parity and on to 1.2428

The Original Entry – 0.8859 with Loss Stop 0.8316 (which I don’t expect to be revisted). This is a 1 : 6.57 Risk : Reward Trade

Next 'Stall point' (Extended Progress Decay) before Target will be 0.9898 which occurs just post taking out of the RH1 at 0.9849

Any late entries should bare this in mind extreme Loss Stops at 0.8771 which is now some way away.

Take a look at the AUDUSD.

Following landing the big Macro Trade of Gold from $962 to $1300 2 months early, I am having a stab at a new long term set up.

I have Highlighted the recent Break in the AUDUSD – The target is through parity and on to 1.2428

The Original Entry – 0.8859 with Loss Stop 0.8316 (which I don’t expect to be revisted). This is a 1 : 6.57 Risk : Reward Trade

Next 'Stall point' (Extended Progress Decay) before Target will be 0.9898 which occurs just post taking out of the RH1 at 0.9849

Any late entries should bare this in mind extreme Loss Stops at 0.8771 which is now some way away.

Take a look at the AUDUSD.