I hadn’t made any significant changes to my strategy for over ten years, but last year was different – I stopped using a stop-loss. Shock! Horror! Trading suicide? Or is there another way to control risk?

Let me explain. I trade potential trend continuation after retracement on UK equities mainly drawn from FTSE100. When the market is rising the equities that trigger will generally be in a good up trend, strong and outperforming the FTSE100 index. Conversely, when the market is falling they will generally be in a good down trend, weak and under performing the index.

I’ve always had problems with my stop-losses on two counts. Firstly, that all too familiar and frustrating experience of price taking out my stop and then shooting off in the right direction leaving me behind. Increasing my paranoia that the market is out to get me personally.

Secondly, when a stop-loss takes me out of the trade I am left looking for another entry whilst the conditions of my strategy are still valid, taking on another dose of risk in the process. A number of such “false starts” can be a costly business.

There had to be a better way of controlling my risk and a hedging strategy is proving to be the answer. At the point where I would have taken my stop-loss I now hedge my equity trade with a pro-rata contra position on the index (FTSE100).

Rather surprisingly, perhaps, the net result of the hedge itself proves profitable in its own right, more often than not, which reflects the relative strength or weakness of the equities that that I mentioned earlier. Naturally, that’s not always the case and there can be instances of the hedge leaving you in a worse position than had you taken the stop-loss in the first place. On balance, though, I have found the strategy advantageous (so far, I hasten to add). There are other disadvantages which I will touch on after a couple of examples.

Here they are:

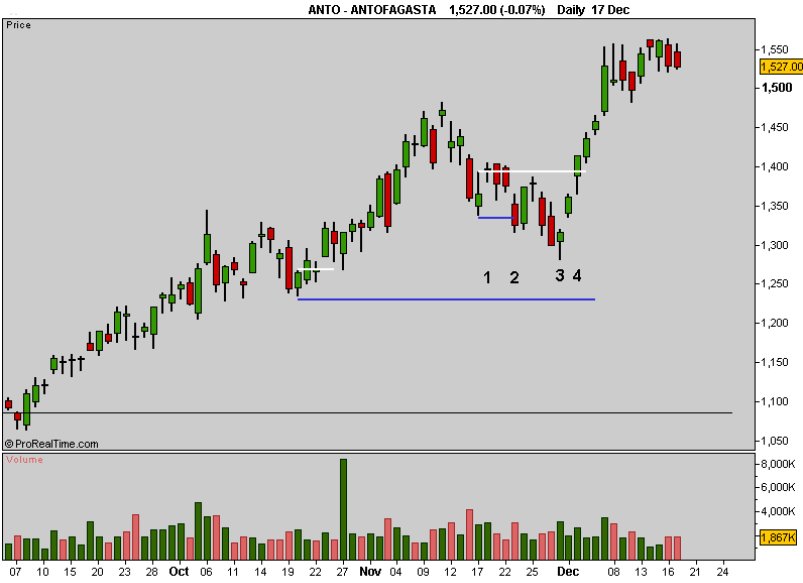

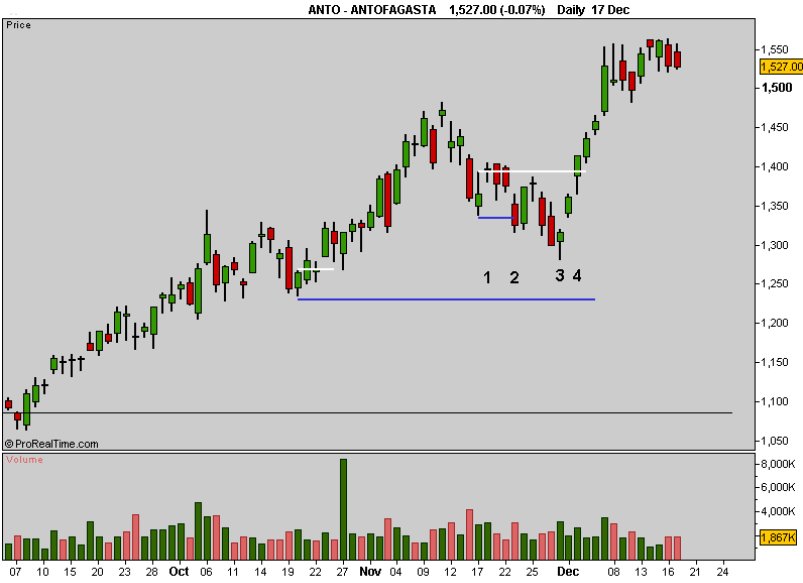

1. Long entry at 1401.

2. I would have been stopped out at 1330 for a loss of -71 points. Instead I hedged with a pro-rata FTSE short at 5671.

3. At this point ANTO was 1315, down a further 15 points (1.1%) but FTSE was 5528, down a further 143 points (2.5%). Thus, the hedge itself was in paper Net profit at this stage. Had I been stopped out on the original long trade I would have been looking to re-enter at this point since price was still above the earlier swing low (horizontal blue line). As it happens, in this particular case, I would have been forestalled in this because of the next day’s gap opening and left cursing on the sidelines as things developed.

4. The hedge was taken off at this point with ANTO at 1413 which was + 83 (6.2%) up from the hedge point with FTSE at 5767 only + 96 (2.5%). Thus, there was significant net profit in the hedge itself.

1. Long entry at 1080

2. Would have been stopped out at 1060 for -20, but hedged instead with a

pro-rata FTSE short at 5618

3. The second dip below the entry swing low nullified conditions, so both the

Original trade and FTSE hedge were closed at that point. The original trade at

1060 for no further loss from the level it was at when the hedge was entered

and the hedge FTSE short at 5578 for a profit of 40 points. The net profit from

the hedge made this a break even trade overall. Pity I shut it down given what

happened next!!

The main disadvantages to such a hedging strategy are, firstly, that you may not have a suitable hedging vehicle for the instrument(s) you trade. Secondly, your risk is not set in stone as it is with a stop-loss and that may well a major stumbling block to you.

Nonetheless I hope you think it worth a look.

1. Long entry at 1080

2. Would have been stopped out at 1060 for -20, but hedged instead with a pro-rata FTSE short at 5618

3. The second dip below the entry swing low nullified conditions, so both the Original trade and FTSE hedge were closed at that point. The original trade at 1060 for no further loss from the level it was at when the hedge was entered and the hedge FTSE short at 5578 for a profit of 40 points. The net profit from the hedge made this a break even trade overall. Pity I shut it down given what happened next!!

The main disadvantages to such a hedging strategy are, firstly, that you may not have a suitable hedging vehicle for the instrument(s) you trade. Secondly, your risk is not set in stone as it is with a stop-loss and that may well a major stumbling block to you.

Nonetheless I hope you think it worth a look.

Let me explain. I trade potential trend continuation after retracement on UK equities mainly drawn from FTSE100. When the market is rising the equities that trigger will generally be in a good up trend, strong and outperforming the FTSE100 index. Conversely, when the market is falling they will generally be in a good down trend, weak and under performing the index.

I’ve always had problems with my stop-losses on two counts. Firstly, that all too familiar and frustrating experience of price taking out my stop and then shooting off in the right direction leaving me behind. Increasing my paranoia that the market is out to get me personally.

Secondly, when a stop-loss takes me out of the trade I am left looking for another entry whilst the conditions of my strategy are still valid, taking on another dose of risk in the process. A number of such “false starts” can be a costly business.

There had to be a better way of controlling my risk and a hedging strategy is proving to be the answer. At the point where I would have taken my stop-loss I now hedge my equity trade with a pro-rata contra position on the index (FTSE100).

Rather surprisingly, perhaps, the net result of the hedge itself proves profitable in its own right, more often than not, which reflects the relative strength or weakness of the equities that that I mentioned earlier. Naturally, that’s not always the case and there can be instances of the hedge leaving you in a worse position than had you taken the stop-loss in the first place. On balance, though, I have found the strategy advantageous (so far, I hasten to add). There are other disadvantages which I will touch on after a couple of examples.

Here they are:

1. Long entry at 1401.

2. I would have been stopped out at 1330 for a loss of -71 points. Instead I hedged with a pro-rata FTSE short at 5671.

3. At this point ANTO was 1315, down a further 15 points (1.1%) but FTSE was 5528, down a further 143 points (2.5%). Thus, the hedge itself was in paper Net profit at this stage. Had I been stopped out on the original long trade I would have been looking to re-enter at this point since price was still above the earlier swing low (horizontal blue line). As it happens, in this particular case, I would have been forestalled in this because of the next day’s gap opening and left cursing on the sidelines as things developed.

4. The hedge was taken off at this point with ANTO at 1413 which was + 83 (6.2%) up from the hedge point with FTSE at 5767 only + 96 (2.5%). Thus, there was significant net profit in the hedge itself.

1. Long entry at 1080

2. Would have been stopped out at 1060 for -20, but hedged instead with a

pro-rata FTSE short at 5618

3. The second dip below the entry swing low nullified conditions, so both the

Original trade and FTSE hedge were closed at that point. The original trade at

1060 for no further loss from the level it was at when the hedge was entered

and the hedge FTSE short at 5578 for a profit of 40 points. The net profit from

the hedge made this a break even trade overall. Pity I shut it down given what

happened next!!

The main disadvantages to such a hedging strategy are, firstly, that you may not have a suitable hedging vehicle for the instrument(s) you trade. Secondly, your risk is not set in stone as it is with a stop-loss and that may well a major stumbling block to you.

Nonetheless I hope you think it worth a look.

1. Long entry at 1080

2. Would have been stopped out at 1060 for -20, but hedged instead with a pro-rata FTSE short at 5618

3. The second dip below the entry swing low nullified conditions, so both the Original trade and FTSE hedge were closed at that point. The original trade at 1060 for no further loss from the level it was at when the hedge was entered and the hedge FTSE short at 5578 for a profit of 40 points. The net profit from the hedge made this a break even trade overall. Pity I shut it down given what happened next!!

The main disadvantages to such a hedging strategy are, firstly, that you may not have a suitable hedging vehicle for the instrument(s) you trade. Secondly, your risk is not set in stone as it is with a stop-loss and that may well a major stumbling block to you.

Nonetheless I hope you think it worth a look.

Last edited by a moderator: