The Articles section of T2W is a veritable repository of trading knowledge, experience and ideas. It’s compiled with one aim in mind: to help you achieve your trading objectives. At the time of writing (March 2012), there are 468 articles in total which, between them, have received well in excess of 4.6 million views - and counting! There are contributions from some of the best known experts in their field, including: Jake Bernstein, John Bollinger, Linda Bradford Raschke, Dr Alexander Elder, Steve Nison, William O'Neil, Martin J. Pring and Brett N. Steenbarger - to name but a few.

However, unless you’ve been a T2W member since 2005 and diligently read all of the contributions as and when they were published – you’ve got a mountain of work ahead of you if you are to read them all. This guide shows you how to navigate your way through this section and find the articles that are relevant to you, right now, quickly and easily. In the event that the filters you utilise result in a short list that’s not that short, we show you how to use the statistics provided to refine your search further and find what you want.

Topics

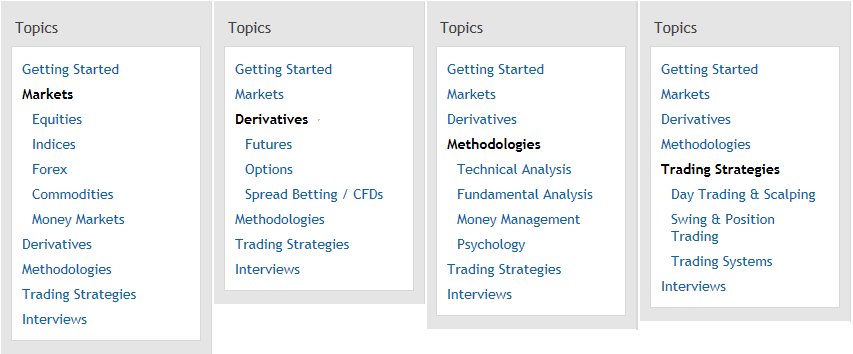

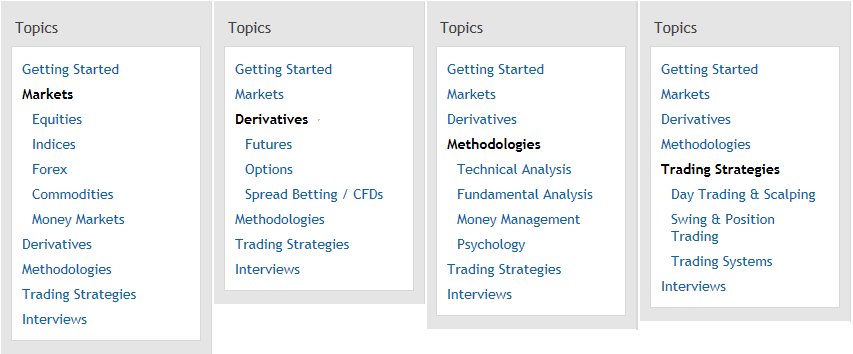

The basic layout is pretty self-explanatory, but there are a few things to keep in mind, starting with ‘Topics’ in the top left hand corner. There are six topics listed, the middle four of which (Markets, Derivatives, Methodologies & Trading Strategies) have categories. Familiarise yourself with all the categories, as these provide a good starting point for finding articles on your chosen subject.

Fig 1 – Topics

Suppose you’re interested in articles on Gold; start by looking in ‘Commodities’ under Markets. Or articles on Level 2; try looking in ‘Day Trading & Scalping’ under Trading Strategies. You get the idea. Admittedly, this isn’t so easy if you’re a complete newbie who still thinks Forex is a brand of Australian lager. If this describes you, just stab a guess and follow your nose – its fun and a great way to learn your way around!

Sorting tabs & index

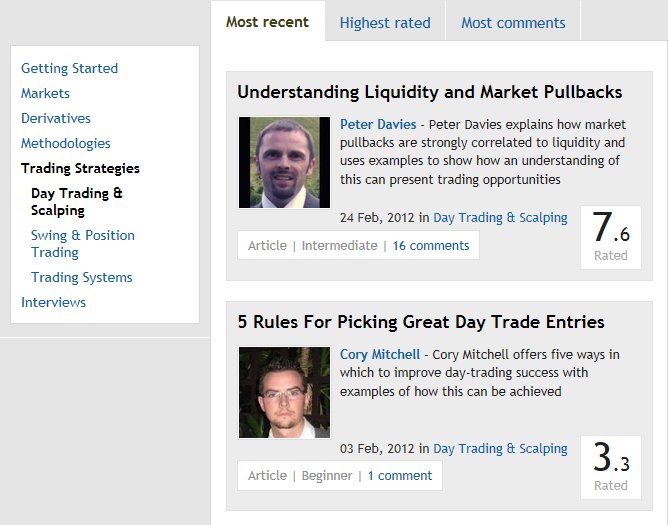

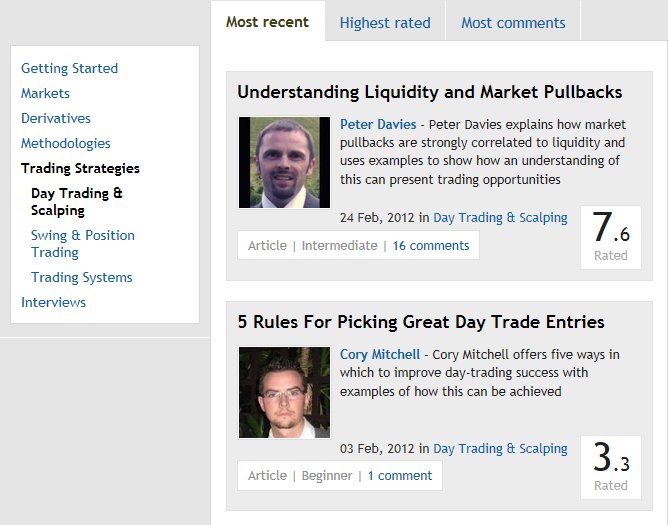

Each time you click on the main Articles tab in the red header panel at the top of the page, the default setting will open up the ‘Most recent’ articles. You can change this to ‘Highest rated’ and ‘Most comments’ at any time, and subsequent searches will be listed accordingly. The software will only revert to the default setting when you log out of – and then back in to – the Articles section.

Every article is graded Beginner, Intermediate or Advanced. Currently, it’s not possible to sort articles by each grade so, if this is something you want to do, you’ll have to do it manually. It’s important to check the grade of an article before rating it. Some members forget to do this and then give a poor rating to a Beginner article because it’s too basic or, similarly, a poor rating to an Advanced article because it contains jargon and complex ideas beyond their current level of understanding.

Fig 2 – Sorting Tabs & Index

At the time of writing, In Fig 2, above – the two most recent articles in the ‘Day Trading & Scalping’ category, listed under Trading Strategies, are displayed. If an article is listed in other categories, these will be shown beneath the synopsis next to the publish date. If there are other articles by the same author, you can access these – and read a short biography about him/her - by clicking on their name. Accompanying each article is a discussion thread which you may access by clicking on the comment(s) link next to the article’s grade.

Ratings

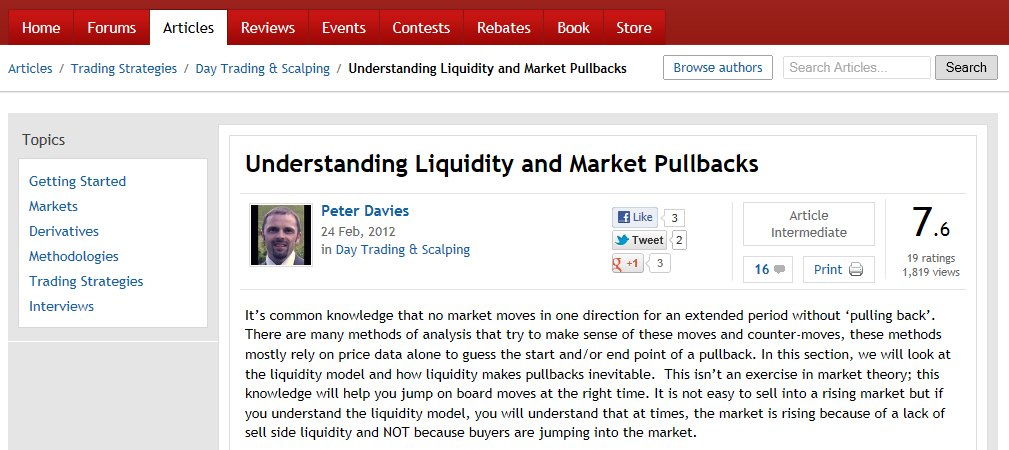

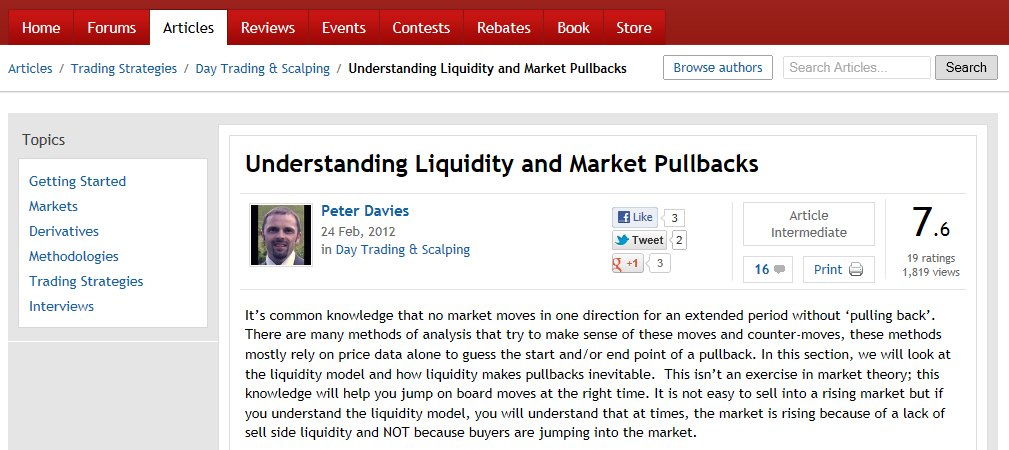

All T2W registered members can rate an article once. They may post in the article’s discussion thread if they particularly liked or disliked it - and indicate the rating they gave it. However, most don’t. Moreover, there’s no knowing why each member rates an article the way they do. Consequently, this is a very crude gauge of sentiment and only reflects the views of a microscopic percentage of members. The index page only gives the average rating, whereas the article itself provides more detail. If you click on the first article shown in Fig 2, it opens up Peter Davis’ contribution entitled: ‘Understanding Liquidity and Market Pullbacks’.

Fig 3 - Peter Davies’ Article

On the right hand side, as well as the average rating figure of 7.6 (that’s also displayed on the main index page), you can see the number of ratings it’s received and the number of people who have viewed it. Generally, the higher these two figures are, the more meaningful the average rating figure becomes. Of the last 50 articles published, the highest number of ratings is 48 and the lowest is just 1. If you look at the second article in Fig 2 by Cory Mitchell, entitled: ‘5 Rules for Picking Great Day Trade Entries’, you’ll see that it’s rated by 24 people, giving it a lowly average of just 3.3. Unfortunately, none of them have posted on the discussion thread saying why they didn’t like it and why they gave it such a low rating. The one comment that has been posted is positive - saying, “Great article simple clear guidelines particularly about trend.” Presumably, if this person rated the article they would have given it a score higher than 3. The point being that it would be a mistake to automatically assume that an article with a low rating is without merit and not worth reading. By the same token, the highest rated article to date enjoys an impressive average of 9.3, but, it’s only received three ratings and no comments at all on its discussion thread. This could be because it’s graded Advanced and is on a specialist subject which, likely as not, will only appeal to a minority of members. Whatever the case, it’s fair to say that if you follow ratings figures blindly and in isolation, you may find them misleading.

Ratings combined with other filters

If you combine the article rating and the number of people who rated it, with the number of views it’s had and the number of comments it’s attracted, you start to get a more rounded impression of the impact it’s having - be it good or bad. This might be a better gauge of whether an article is likely to contain ideas worthy of your time and attention. Of the last 50 articles published, these are the key averages per article:

Average Rating: 5.4

Average No. of Ratings: 14.2

Average No. of Views: 2,790

Average No. of Comments: 4.8

To round these numbers up, we can say that any article rated 6 or more, with 15 ratings or more, 2,800 views or more and 5 comments or more - has attracted considerable interest – relatively speaking. If the rating is well above average, then it’s reasonable to conclude that it’s likely to contain ideas which other T2W members deem to be of real merit. Visa versa if the ratings are low. Lots of comments combined with an average rating suggest controversy, which has resulted in vigorous debate.

If one applies the above metric to Peter Davies’ article, you’ll see that it enjoys a high rating and easily beats all the averages - except the number of views. However, it’s important to keep in mind that the averages are based on the last 50 articles which, roughly speaking, cover a year. At the time the statistics were collated, his article was only three weeks old. Inevitably, over time, the number of views it receives will rise. Additionally, it’s graded as Intermediate, so it’s probable that a significant tranche of the membership won’t bother to read it, fearing that it may be beyond their current level of understanding. Based on these statistical filters, combined with a little common sense, you can conclude that Peter Davies’ article is a ‘must read’ for all aspiring day traders who want a better understanding of liquidity and how and why market pullbacks occur.

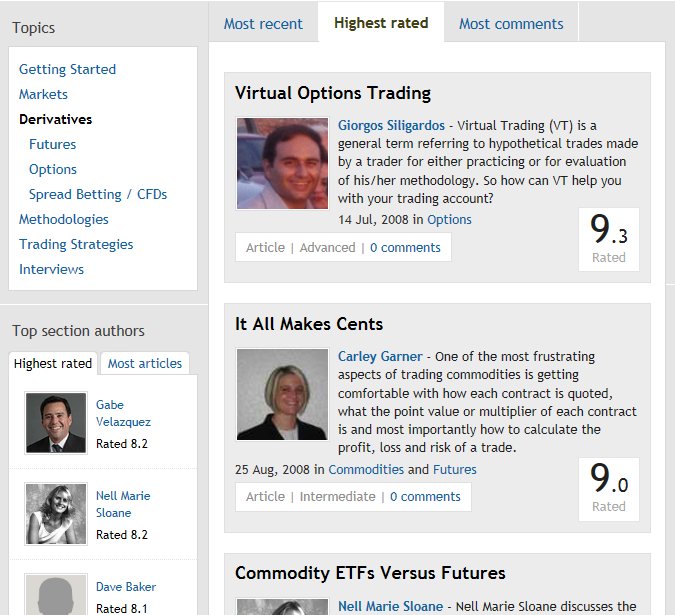

Top section authors

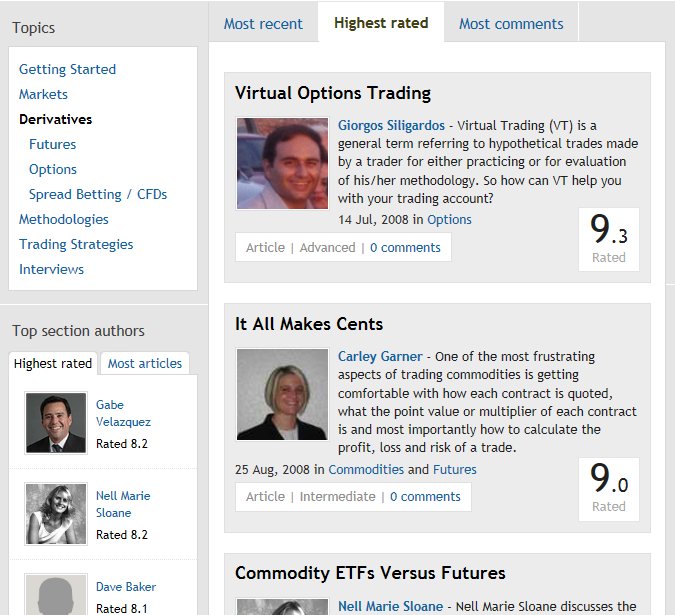

Beneath the ‘Topics’ panel on the left hand side is another panel entitled: ‘Top section authors’ (TSA). You’ll see two tabs, the first of which is ‘Highest rated’ which, as the astute amongst you will observe, is the same as the second of the three main sorting tabs at the top of the page. On the face of it, this is unnecessary duplication and misleading. Fig 4, below – shows articles listed under the Derivatives topic, sorted via the ‘Highest rated’ tab. The TSA panel also lists those that are ‘Highest rated’.

Fig 4 – Top Section Authors (TSA)

As you can see, the authors and ratings in the TSA panel are rather different from those listed in the main index. Nell Marie Sloane is the only common denominator, although she appears 2nd in the TSA listing and 3rd in the main index. This apparent anomaly is explained by the fact that the TSA panel displays the average ratings based on all the articles in the section by that author, whereas, the ratings on the main index relate to the specific article listed. Incidentally, the first article by Giorgos Siligardos entitled ‘Virtual Options Trading’ is the one referred to earlier that’s currently the highest rated article.

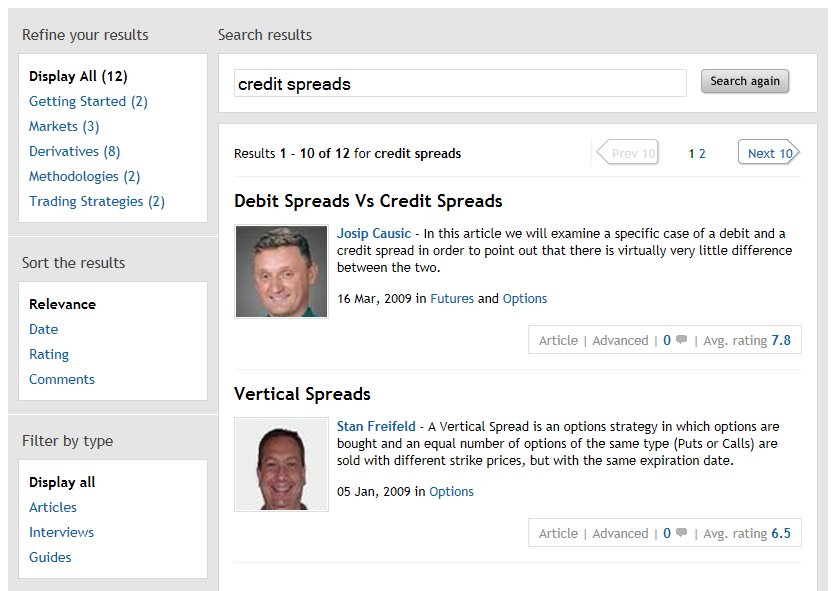

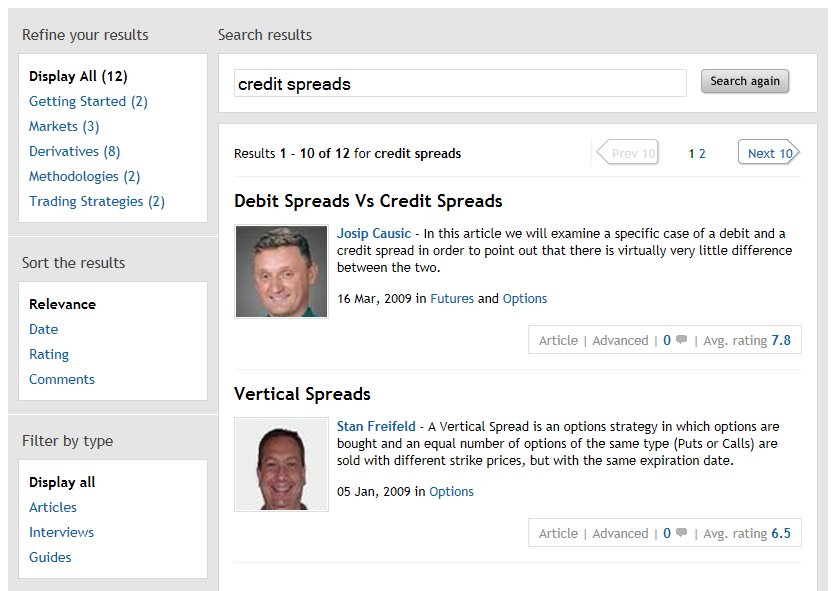

Search facility

Just under the main red header panel towards the right hand side you’ll see the ‘Search Articles...’ box. In Fig 5 below, the term ‘credit spreads’ has been entered and the search button clicked. The total number of results is displayed in the ‘Refine your results’ panel to the left - 12 in this case. The default setting is to display articles most relevant to the search criteria. So, here you’ll see that credit spreads is included in the title of the first article – as good an indication as any that it’s going to be about the chosen subject! Conversely, the 12th article listed by John Maudlin entitled: ‘The Yield Curve’ (not shown in Fig 5), may only contain a passing reference to credit spreads.

Fig 5 – Search Facility

The ‘Refine your results’ panel displays the number of articles in each of the main topics that relate to your search criteria. You’ll notice that articles appear in 5 of the 6 main topics and, if you tally up the numbers listed it comes to 17, i.e. 5 more than the results total. This is because most articles are listed under more than one topic (or category). If you look at the 1st article entitled: ‘Debit Spreads Vs Credit Spreads’ by Josip Causic, you’ll see that it appears in the Futures and Options categories. Now, a little test: without referring back to Fig 1, can you remember which topic these two categories are listed under?

The 2nd panel on the left entitled ‘Sort the results’ enables you to change the default setting from Relevance to Date, Rating or Comments. The 3rd panel enables you to filter by type. In reality, most articles are in the Articles section although, as it happens, this one is a relatively rare example of one listed under Guides.

Articles sub-forum

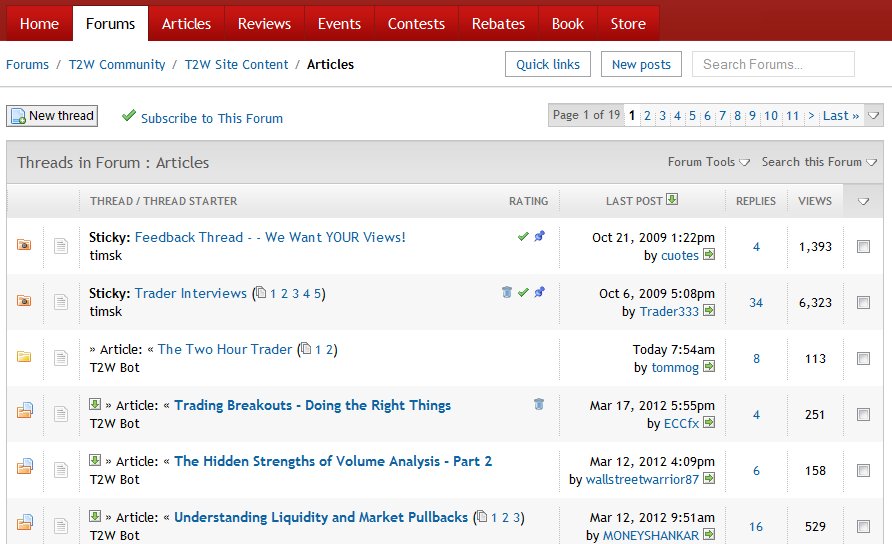

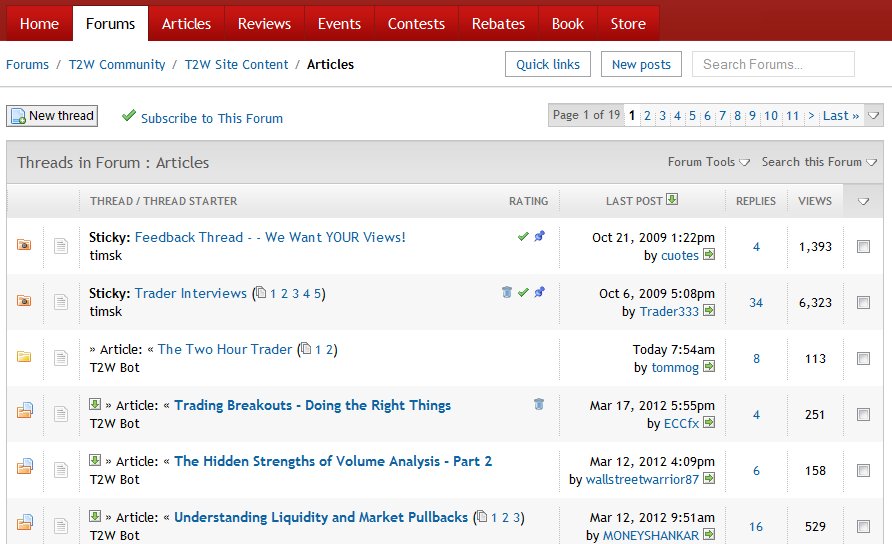

Here’s an alternative way of searching for articles that you may not have considered. Click on ‘Forum’ next to ‘Home’ in the main red header panel. Scroll down to the forum category entitled ‘T2W Community’. The 4th forum of the 5 that are listed is called ‘T2W Site Content’ which contains 5 sub-forums, the first of which is ‘Articles’. This opens up a list of all the discussion threads for each article published, as shown in Fig 6, below.

Fig 6 – Articles Discussion Threads

From here, you can conduct searches in the same way as you would any other forum on the site. (For more info’ on this, check out HOW TO USE THE SEARCH FACILITY in the Essentials Of 'General Trading Chat' Sticky.) If you click on THREAD, all the articles will be listed in alphabetical order; something you can’t do in the Articles section itself. Unfortunately, THREAD STARTER isn’t useful in this instance as all the threads are generated automatically by the T2W Bot! But it’s a great tool on all the other forums for finding threads started by specific members. Sorting threads by RATING would, potentially, be useful if more members rated threads. If you hover your cursor over the stars you can see the number of votes cast which is as important – if not more so - than the star rating itself. As a rough rule of thumb, any rating with more than half a dozen votes is high. LAST POST is the default forum setting and that’s how the threads are sorted in the image above, indicated by the small green down arrow. The last two categories of REPLIES and VIEWS are especially useful as they indicate the threads that have generated the most interest amongst members. Keep in mind that while the number shown under REPLIES is the same as that shown in ‘Comments’ in the main Articles section - VIEWS relates to the number of views of the discussion thread - not the number of views of the actual article! On the basis that ‘the whole is greater than the sum of its parts’, posts in the discussion thread can add real meat to an article. That said, using members comments in discussion threads as a tool to filter articles either to read or to ignore is not recommended. It’s best to read them yourself and make up your own mind!

And finally - a plea . . .

Please post on the discussion thread accompanying this guide to let us know how you use the Articles section, what you like or don’t like about it and how it could be improved. Additionally, if you would like to contribute an article, please get in touch with Tim timsk or Paul Trader333 to discuss your idea(s). We particularly welcome member generated content and will work with you to ensure your contribution is the best it can be. Alternatively, whilst surfing the net, perhaps you’ve come across a great article that might be of inertest to T2W members? If so, post a link here or forward it to Tim or Paul so that they can check it out. Who knows, perhaps the next article published will be something you’ve written or by an author you’ve recommended!

However, unless you’ve been a T2W member since 2005 and diligently read all of the contributions as and when they were published – you’ve got a mountain of work ahead of you if you are to read them all. This guide shows you how to navigate your way through this section and find the articles that are relevant to you, right now, quickly and easily. In the event that the filters you utilise result in a short list that’s not that short, we show you how to use the statistics provided to refine your search further and find what you want.

Topics

The basic layout is pretty self-explanatory, but there are a few things to keep in mind, starting with ‘Topics’ in the top left hand corner. There are six topics listed, the middle four of which (Markets, Derivatives, Methodologies & Trading Strategies) have categories. Familiarise yourself with all the categories, as these provide a good starting point for finding articles on your chosen subject.

Fig 1 – Topics

Suppose you’re interested in articles on Gold; start by looking in ‘Commodities’ under Markets. Or articles on Level 2; try looking in ‘Day Trading & Scalping’ under Trading Strategies. You get the idea. Admittedly, this isn’t so easy if you’re a complete newbie who still thinks Forex is a brand of Australian lager. If this describes you, just stab a guess and follow your nose – its fun and a great way to learn your way around!

Sorting tabs & index

Each time you click on the main Articles tab in the red header panel at the top of the page, the default setting will open up the ‘Most recent’ articles. You can change this to ‘Highest rated’ and ‘Most comments’ at any time, and subsequent searches will be listed accordingly. The software will only revert to the default setting when you log out of – and then back in to – the Articles section.

Every article is graded Beginner, Intermediate or Advanced. Currently, it’s not possible to sort articles by each grade so, if this is something you want to do, you’ll have to do it manually. It’s important to check the grade of an article before rating it. Some members forget to do this and then give a poor rating to a Beginner article because it’s too basic or, similarly, a poor rating to an Advanced article because it contains jargon and complex ideas beyond their current level of understanding.

Fig 2 – Sorting Tabs & Index

At the time of writing, In Fig 2, above – the two most recent articles in the ‘Day Trading & Scalping’ category, listed under Trading Strategies, are displayed. If an article is listed in other categories, these will be shown beneath the synopsis next to the publish date. If there are other articles by the same author, you can access these – and read a short biography about him/her - by clicking on their name. Accompanying each article is a discussion thread which you may access by clicking on the comment(s) link next to the article’s grade.

Ratings

All T2W registered members can rate an article once. They may post in the article’s discussion thread if they particularly liked or disliked it - and indicate the rating they gave it. However, most don’t. Moreover, there’s no knowing why each member rates an article the way they do. Consequently, this is a very crude gauge of sentiment and only reflects the views of a microscopic percentage of members. The index page only gives the average rating, whereas the article itself provides more detail. If you click on the first article shown in Fig 2, it opens up Peter Davis’ contribution entitled: ‘Understanding Liquidity and Market Pullbacks’.

Fig 3 - Peter Davies’ Article

On the right hand side, as well as the average rating figure of 7.6 (that’s also displayed on the main index page), you can see the number of ratings it’s received and the number of people who have viewed it. Generally, the higher these two figures are, the more meaningful the average rating figure becomes. Of the last 50 articles published, the highest number of ratings is 48 and the lowest is just 1. If you look at the second article in Fig 2 by Cory Mitchell, entitled: ‘5 Rules for Picking Great Day Trade Entries’, you’ll see that it’s rated by 24 people, giving it a lowly average of just 3.3. Unfortunately, none of them have posted on the discussion thread saying why they didn’t like it and why they gave it such a low rating. The one comment that has been posted is positive - saying, “Great article simple clear guidelines particularly about trend.” Presumably, if this person rated the article they would have given it a score higher than 3. The point being that it would be a mistake to automatically assume that an article with a low rating is without merit and not worth reading. By the same token, the highest rated article to date enjoys an impressive average of 9.3, but, it’s only received three ratings and no comments at all on its discussion thread. This could be because it’s graded Advanced and is on a specialist subject which, likely as not, will only appeal to a minority of members. Whatever the case, it’s fair to say that if you follow ratings figures blindly and in isolation, you may find them misleading.

Ratings combined with other filters

If you combine the article rating and the number of people who rated it, with the number of views it’s had and the number of comments it’s attracted, you start to get a more rounded impression of the impact it’s having - be it good or bad. This might be a better gauge of whether an article is likely to contain ideas worthy of your time and attention. Of the last 50 articles published, these are the key averages per article:

Average Rating: 5.4

Average No. of Ratings: 14.2

Average No. of Views: 2,790

Average No. of Comments: 4.8

To round these numbers up, we can say that any article rated 6 or more, with 15 ratings or more, 2,800 views or more and 5 comments or more - has attracted considerable interest – relatively speaking. If the rating is well above average, then it’s reasonable to conclude that it’s likely to contain ideas which other T2W members deem to be of real merit. Visa versa if the ratings are low. Lots of comments combined with an average rating suggest controversy, which has resulted in vigorous debate.

If one applies the above metric to Peter Davies’ article, you’ll see that it enjoys a high rating and easily beats all the averages - except the number of views. However, it’s important to keep in mind that the averages are based on the last 50 articles which, roughly speaking, cover a year. At the time the statistics were collated, his article was only three weeks old. Inevitably, over time, the number of views it receives will rise. Additionally, it’s graded as Intermediate, so it’s probable that a significant tranche of the membership won’t bother to read it, fearing that it may be beyond their current level of understanding. Based on these statistical filters, combined with a little common sense, you can conclude that Peter Davies’ article is a ‘must read’ for all aspiring day traders who want a better understanding of liquidity and how and why market pullbacks occur.

Top section authors

Beneath the ‘Topics’ panel on the left hand side is another panel entitled: ‘Top section authors’ (TSA). You’ll see two tabs, the first of which is ‘Highest rated’ which, as the astute amongst you will observe, is the same as the second of the three main sorting tabs at the top of the page. On the face of it, this is unnecessary duplication and misleading. Fig 4, below – shows articles listed under the Derivatives topic, sorted via the ‘Highest rated’ tab. The TSA panel also lists those that are ‘Highest rated’.

Fig 4 – Top Section Authors (TSA)

As you can see, the authors and ratings in the TSA panel are rather different from those listed in the main index. Nell Marie Sloane is the only common denominator, although she appears 2nd in the TSA listing and 3rd in the main index. This apparent anomaly is explained by the fact that the TSA panel displays the average ratings based on all the articles in the section by that author, whereas, the ratings on the main index relate to the specific article listed. Incidentally, the first article by Giorgos Siligardos entitled ‘Virtual Options Trading’ is the one referred to earlier that’s currently the highest rated article.

Search facility

Just under the main red header panel towards the right hand side you’ll see the ‘Search Articles...’ box. In Fig 5 below, the term ‘credit spreads’ has been entered and the search button clicked. The total number of results is displayed in the ‘Refine your results’ panel to the left - 12 in this case. The default setting is to display articles most relevant to the search criteria. So, here you’ll see that credit spreads is included in the title of the first article – as good an indication as any that it’s going to be about the chosen subject! Conversely, the 12th article listed by John Maudlin entitled: ‘The Yield Curve’ (not shown in Fig 5), may only contain a passing reference to credit spreads.

Fig 5 – Search Facility

The ‘Refine your results’ panel displays the number of articles in each of the main topics that relate to your search criteria. You’ll notice that articles appear in 5 of the 6 main topics and, if you tally up the numbers listed it comes to 17, i.e. 5 more than the results total. This is because most articles are listed under more than one topic (or category). If you look at the 1st article entitled: ‘Debit Spreads Vs Credit Spreads’ by Josip Causic, you’ll see that it appears in the Futures and Options categories. Now, a little test: without referring back to Fig 1, can you remember which topic these two categories are listed under?

The 2nd panel on the left entitled ‘Sort the results’ enables you to change the default setting from Relevance to Date, Rating or Comments. The 3rd panel enables you to filter by type. In reality, most articles are in the Articles section although, as it happens, this one is a relatively rare example of one listed under Guides.

Articles sub-forum

Here’s an alternative way of searching for articles that you may not have considered. Click on ‘Forum’ next to ‘Home’ in the main red header panel. Scroll down to the forum category entitled ‘T2W Community’. The 4th forum of the 5 that are listed is called ‘T2W Site Content’ which contains 5 sub-forums, the first of which is ‘Articles’. This opens up a list of all the discussion threads for each article published, as shown in Fig 6, below.

Fig 6 – Articles Discussion Threads

From here, you can conduct searches in the same way as you would any other forum on the site. (For more info’ on this, check out HOW TO USE THE SEARCH FACILITY in the Essentials Of 'General Trading Chat' Sticky.) If you click on THREAD, all the articles will be listed in alphabetical order; something you can’t do in the Articles section itself. Unfortunately, THREAD STARTER isn’t useful in this instance as all the threads are generated automatically by the T2W Bot! But it’s a great tool on all the other forums for finding threads started by specific members. Sorting threads by RATING would, potentially, be useful if more members rated threads. If you hover your cursor over the stars you can see the number of votes cast which is as important – if not more so - than the star rating itself. As a rough rule of thumb, any rating with more than half a dozen votes is high. LAST POST is the default forum setting and that’s how the threads are sorted in the image above, indicated by the small green down arrow. The last two categories of REPLIES and VIEWS are especially useful as they indicate the threads that have generated the most interest amongst members. Keep in mind that while the number shown under REPLIES is the same as that shown in ‘Comments’ in the main Articles section - VIEWS relates to the number of views of the discussion thread - not the number of views of the actual article! On the basis that ‘the whole is greater than the sum of its parts’, posts in the discussion thread can add real meat to an article. That said, using members comments in discussion threads as a tool to filter articles either to read or to ignore is not recommended. It’s best to read them yourself and make up your own mind!

And finally - a plea . . .

Please post on the discussion thread accompanying this guide to let us know how you use the Articles section, what you like or don’t like about it and how it could be improved. Additionally, if you would like to contribute an article, please get in touch with Tim timsk or Paul Trader333 to discuss your idea(s). We particularly welcome member generated content and will work with you to ensure your contribution is the best it can be. Alternatively, whilst surfing the net, perhaps you’ve come across a great article that might be of inertest to T2W members? If so, post a link here or forward it to Tim or Paul so that they can check it out. Who knows, perhaps the next article published will be something you’ve written or by an author you’ve recommended!

Last edited by a moderator: