You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Hi DJ

Good stuff - I appreciate you may not want to reveal too much about your own method (s) as you have already commented - and that of course is your prerogative.

With you being a full time and long serving trader, I should imagine you have taken thousands of similar trades on forex pairs and therefore do have a nice record of all your past performances.

I therefore would love to see how it compares with my own short term intraday forex trading past as I am sure we could both learn something from each other.

My own win ratios based on the last 4/5 yrs ( since i got consistent) with multi thousands of trades - ranges from as low as approx 61/2% on 100 ( live) trades - to as high as 87% on another batch of 100 trades. I therefore assume I am normally in the 70-75% win ratio range.

How's that compare to you ?

Next point - and this as been raised recently by another member - I regularly have 2 or 3 consecutive losing trades - which I don't like - but accept - as I also have many more consecutive winning trades - 10 -15 being quite achievable over a 2 or 3 day period -

My maximum consecutive losses have been 7 and my maximum consecutive wins have been mid twenties. How's that compare with your stats ?

Next point - you may not want to say what percentage of your capital you uses as the stake size on your trades - but with multi trading and any trade with a RR of above 1 - you should be able to make 2% per day - even if you are only using 0.5% stake size of a reasonably large retail capital account. I have days ranging from 1% to over 5% - but my first priority is not to have a losing day .

What are your own MM priorities in order of concern ?

I generally trade a "basket" of 4 -6 currency pairs and have only really majored on one in the past - which was the EU. Nowadays the EU might only account for 30 -40% of my pips - whereas 3 years ago it might have been as high as 60-75%.

Are you 90% EU and GU ??

I am sure there are loads of other questions and queries I might have - but fully understand if you did not want to go into detail on an open forum - that's no problem and therefore I am quite happy to leave it at that.

Have a good January - but with results like you have been showing - I am sure you will ;-)

Regards

F

Good stuff - I appreciate you may not want to reveal too much about your own method (s) as you have already commented - and that of course is your prerogative.

With you being a full time and long serving trader, I should imagine you have taken thousands of similar trades on forex pairs and therefore do have a nice record of all your past performances.

I therefore would love to see how it compares with my own short term intraday forex trading past as I am sure we could both learn something from each other.

My own win ratios based on the last 4/5 yrs ( since i got consistent) with multi thousands of trades - ranges from as low as approx 61/2% on 100 ( live) trades - to as high as 87% on another batch of 100 trades. I therefore assume I am normally in the 70-75% win ratio range.

How's that compare to you ?

Next point - and this as been raised recently by another member - I regularly have 2 or 3 consecutive losing trades - which I don't like - but accept - as I also have many more consecutive winning trades - 10 -15 being quite achievable over a 2 or 3 day period -

My maximum consecutive losses have been 7 and my maximum consecutive wins have been mid twenties. How's that compare with your stats ?

Next point - you may not want to say what percentage of your capital you uses as the stake size on your trades - but with multi trading and any trade with a RR of above 1 - you should be able to make 2% per day - even if you are only using 0.5% stake size of a reasonably large retail capital account. I have days ranging from 1% to over 5% - but my first priority is not to have a losing day .

What are your own MM priorities in order of concern ?

I generally trade a "basket" of 4 -6 currency pairs and have only really majored on one in the past - which was the EU. Nowadays the EU might only account for 30 -40% of my pips - whereas 3 years ago it might have been as high as 60-75%.

Are you 90% EU and GU ??

I am sure there are loads of other questions and queries I might have - but fully understand if you did not want to go into detail on an open forum - that's no problem and therefore I am quite happy to leave it at that.

Have a good January - but with results like you have been showing - I am sure you will ;-)

Regards

F

Last edited:

Hi Forexmospherian,

I hope you don't take this the wrong way, but I believe there is way too much focus on win rate amongst retail traders. (Unfortunately at least one trade statement I posted had a sequence of only winning trades and I therefore felt compelled to highlight in that post that this was as much a function of luck as skill). Personally, I'm more interested in risk adjusted performance.

So rather than dwell on win rate,I'm more comfortable highlighting: risk%, draw-down, profit factor/expectancy, opportunity factor, costs/friction, asset volatility etc as metrics to focus on (lets leave aside Calmar/SAI ratios etc for now 🙂 ). Apologies if this is 'teaching you to suck eggs' but for a lot of people reading it won't be...

I must also say I'm surprised that you have only ever experienced a sequence of 7 losing trades (especially with small stops). My largest sequence of losing trades has been much larger - as a result my %risk/trade is low.

Again, without trying to be contentious, I'd say a return of 2%/day is very (unrealistically?) high - 480% pa ! Do you generate this level of return? I've had good days, sure, but to average that?

You asked: "What are your own MM priorities in order of concern ?" Maybe I've misunderstood the question, but Paul Tudor Jones put it well when he said: "I'm always thinking about losing money as opposed to making money. Don't focus on making money, focus on protecting what you have".

I focus a lot on EU and GU yes. However, I do trade other pairs.

I'm aware my reply has lacked a little depth - there are a couple of reasons: Firstly, and most importantly, I need to grab another beer from the fridge 🙂

Secondly, I've both been misunderstood & taken out of context on other threads, not necessarily by the person I was replying to, but by others... am currently having a re-think on how/if I participate further on this site.

Hi DJ,

That's an absolute fantastic post and please if you can elaborate on what you wanted to say, as please don't think about teaching anyone to suck eggs, as I would really enjoy reading how you go about risk adjusted trading.

Who GAF what anyone thinks, as I'm sure like me, others would love to read it.

Best

John.

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Hi Forexmospherian,

... am currently having a re-think on how/if I participate further on this site.

Hi DJ

No problem at all with your answer and I really hope that you will carry on participating with your comments on this site.

Believe it or not , I actually agree with a lot of things you have been saying and I know myself you are never going to satisfy all members - what ever you may say - or however you act - so please don't worry about it.

Yes win ratio's are over rated - although I would prefer a win ratio of over 65% compared to say 45% - some scalpers even with 80% win rates over hundreds of trades - can lose money if their stops are too large - or they have no stop at all.

It is the whole mix - as you have commented that is important - and getting your own "bespoke" balance - that suit you - more than it suiting all and sundry.

My own MM priority is not to have a losing day. I place staying in the "black" above gaining another 25 pips or another 2% return on the day's figures.

I also use "free trades" - ie part of original stake - with stop already in profit - so then it's of no real risk - and if I get stopped out - its still gives me a winning trade - but if I am lucky and I have caught more than a small wave - I might gain another 40 -70 or even 100+ pips.

By doing this it does assist your performance and especially your RR's

For example if my 70% stake made me say 16 pips and its a RR of 3 and then I leave just my 30% stake on - which might only be 0.2% of my capital and over a few hours or even a day it makes 80 pips - those additional 64 pips have given me a RR of 16 ( 80 pips - 5 pip stop) and even on 0.2% risk - its still a massive 3%+ gain - with only the original risk involved

So to make 2% ongoing a day is possible - yes many days only 1% but the odd day at 5 or 8% really alters the averages on a 19 -22 day month.

Personally - I cannot handle trying to achieve anything like 30% - 50% results pm on say large( $200-$250k) capital accounts - but under $70k its in my comfort zone - and i don't even try and compound - I withdraw profits instead - and use them or spend them ;-)

Reduce the capital account down to a few thousands and the 50 -100% per month is on - but not with compounding - purely with leverage and 2%+ stakes

Trading is not linear relative as far as I am concerned

Have a good week DJ - you should do ;-))

Regards

F

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

EURJPY is also calling for LONGs. Entry is near 141.90 area SL 141.40 TP 142.90 and 143.60 in extension. a cross above 143.50 may drift it to 145 also.

Hi Geever

Cannot really comment as no charts up tonight - but will look prior to Opens and see if you have spotted a good one

GL and have a great week ;-)

Regards

F

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

EURJPY is also calling for LONGs. Entry is near 141.90 area SL 141.40 TP 142.90 and 143.60 in extension. a cross above 143.50 may drift it to 145 also.

Morning Geever

Shame but you got taken out in the Asian session with the EJ falling to 141.22 . Under 141.85 its still in a down bias and you can sell again under there and 60- and I would only be holding back on to buys or taking new ones above 142.00 again

Regards

F

Morning Geever

Shame but you got taken out in the Asian session with the EJ falling to 141.22 . Under 141.85 its still in a down bias and you can sell again under there and 60- and I would only be holding back on to buys or taking new ones above 142.00 again

Regards

F

It means only that your trading style does not match with mine. SL is just to protect from eventual spikes. I have entered again with double position for same target..lets see

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

It means only that your trading style does not match with mine. SL is just to protect from eventual spikes. I have entered again with double position for same target..lets see

Very true - i wish you GL if you have now doubled up and bought again -your style is very different - but if it works for you etc - then no problem - and all the best on it - also remember Japan off today on holiday

Your results are impressive. 👍

How the trading environment, especially the volatility, does influence your trading ?

How the trading environment, especially the volatility, does influence your trading ?

Ldn desks were having fun with cable this morning, which helped net a few pips. Didn't do a great job managing the last euro trade, but it happens... good luck to all.

Bad luck Geever, I'm assuming you were stopped out again for another 50 pip loss on 2x your posn... so about -150 pips across these 2 trades? Have to admit after Friday's data, you've picked some unusual positions. Hope you're not too battered & the next ones work out better.

My tarding style is unique and I don't care for these types of drawdown when i have a logic that market is doing a false move..🙂

Ldn desks were having fun with cable this morning, which helped net a few pips. Didn't do a great job managing the last euro trade, but it happens... good luck to all.

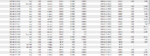

what about this one.. it took me only one and half an hour to trade all this..

Attachments

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

what about this one.. it took me only one and half an hour to trade all this..

Hi Geever

What you have shown there is "efficient" intraday trading - similar to DJ's methods

Swing investment type trading is "inefficient " - ie you might wait 2 days or 2 weeks to get a RR of 3 or 4 - using larger stops.

Some days I get RR's of 4 under 30 mins - efficient and very profitable

I am pleased you do both - are you also a PPND ( Pyramid Peel Never Dump )

Have a good day -

PS - yes I got some scalp buys on EJ above 141.50 - but really need over 142.00+ to look at more

Regards

F

In fact I was wondering whether you were waiting a trending environment before entering a trade.

Thx. Not fully sure I understand your question, but in brief, I like vol.

proTrder

Junior member

- Messages

- 14

- Likes

- 0

Ldn desks were having fun with cable this morning, which helped net a few pips. Didn't do a great job managing the last euro trade, but it happens... good luck to all.

DJ

This is great! Glad to see it is working out for you. How long did this many trades took you to execute? About two hours I guess? If that is the case, what is your trading strategy for this many trades? Are you getting in and out of the market using some sort of indicator? Is there a minimum number of profit target you trade for? To throw a little meat in the bone, can you also post one specific trade like EUR/USD by including the price and time your trade was executed? That can actually help us get a feel of how you were trading.

Thanks!

Last edited:

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Hi Geever, since you ask, I quickly worked out your expectancy based on the 2 EJ trades you called in this thread yesterday and these trades you posted.

(To re-cap you lost -150 pips on EJ across 2 trades, I have not included costs/friction etc).

So, your expectancy can be quickly calculated as follows:

# wins: 16, # losses: 4

avg win size (pips): 10.03, avg loss size (pips): 40.49

eV = 0.8(10.03) + 0.2(-40.49) = (8.02) + (-8.09) = -0.07 pips

Thus, you are losing money and are showing no statistical edge.

PS Fxmo, sry, not so "efficient" ;-)

PPS To any reader, the above calc is quick mental arithmetic on my part, if I've been a d*ck and done my sums wrong please amend accordingly.

Hi DJ

i suppose though it's how Geever treats his different trading formats. For all we know - on the 3 losses assuming 50 pip stops on each one - his stake size might have been small per loss - say 0.5% of capital

On his short term trading - he might be using tight stops and 1- 5% stake - as hes knows he has a higher hit rate.

So therefore a 40 pips of short term win trades might make him say 2 -5% gains - whereas 150 pip of losses might only be 1.5% loss on Capital

I appreciate this would be unusual - as I have seen so many traders accounts were the 100 pip losses are like 8% of capital - and then the 150 pips of wins only add up to 4-5% - so giving the trader a net monetary loss

Would be good to hear off Geever how he operates - but what amazed me if he can intraday trade and read PA in the "noise" - why was he buying the EJ - when it was clearly a sell on Monday - just based on LH's and LL's ??

Regards

F

Last edited:

Well, US retail sales figures yesterday afternoon were a bit of a non-event for me (lack of follow-through after the news). Added about $100 to the P&L, shortly after which I walked away (pic 1 - red box).

This morning was a little better. Started off cautiously, and then saw indications of accumulation in cable. Managed to bank some pips after that was confirmed, but set a conservative profit target due to this morning's USD strength (pic 2).

Hi DJ,

I appreciate why people would block out their account number, and ticket numbers, but why do you block out the times the trades were taken.

Best

John.

Similar threads

- Replies

- 0

- Views

- 162

- Replies

- 0

- Views

- 164