Lightning McQueen

Moderator

- Messages

- 5,029

- Likes

- 841

The Three Keys to the Grail

This is the 2008 continuation saga from the free system forum.

http://www.trade2win.com/boards/free-systems/20862-simple-moving-average-system.html

The first post on this will be links to the research documents and sources for this method.

Don't worry its a light read (and still being worked on so check back for updates to this post)

I am of the firm belief that if you have an understanding of the historical principles that lay behind this method it may be easier to see where I'm trying to go with this with the most simple, easy method of entering a trade I can devise to date.

The First Key

This is founded on the principle of tight stops and a trade that will fly in your favour from the off.

The Second Key

This is founded on the principle of the bouncing ball or how to find the point where momentum stalls and falls back before bouncing up again.

The Third Key

This is the trigger, no method will work well without a specific trigger to get you in a trade at the precise point that will alow the elements of key one and key two to come to together in a seamless entity.

Key One

This can be found on this site, but I will quote from an original source

How To Trade In Stocks

Jesse L. Livermore

1940

first edition

"When a speculator can determine the pivotal point and enterpret the action at that point, he may make a commitment with the positive assurance of being right from the start ...fast and straight movement almost invariably occured after such points were past"

Key Two

Which is the basic foundation of the method, already done to death by myself.

Weekly Trading Education Article

"The 5-period SMA almost acts as a center line or balance point, and, when the line is broken to either side, it is a possible entry or exit point in the market"

Key Three

The trigger, this was developed by me, with pm assistance by Splitlink, thanks mate :clap:

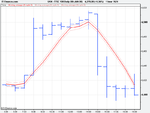

The practical theory of the three keys will be the next post, showing the method rules in full and a chart example so you can follow it in the market next week.

This is the 2008 continuation saga from the free system forum.

http://www.trade2win.com/boards/free-systems/20862-simple-moving-average-system.html

The first post on this will be links to the research documents and sources for this method.

Don't worry its a light read (and still being worked on so check back for updates to this post)

I am of the firm belief that if you have an understanding of the historical principles that lay behind this method it may be easier to see where I'm trying to go with this with the most simple, easy method of entering a trade I can devise to date.

The First Key

This is founded on the principle of tight stops and a trade that will fly in your favour from the off.

The Second Key

This is founded on the principle of the bouncing ball or how to find the point where momentum stalls and falls back before bouncing up again.

The Third Key

This is the trigger, no method will work well without a specific trigger to get you in a trade at the precise point that will alow the elements of key one and key two to come to together in a seamless entity.

Key One

This can be found on this site, but I will quote from an original source

How To Trade In Stocks

Jesse L. Livermore

1940

first edition

"When a speculator can determine the pivotal point and enterpret the action at that point, he may make a commitment with the positive assurance of being right from the start ...fast and straight movement almost invariably occured after such points were past"

Key Two

Which is the basic foundation of the method, already done to death by myself.

Weekly Trading Education Article

"The 5-period SMA almost acts as a center line or balance point, and, when the line is broken to either side, it is a possible entry or exit point in the market"

Key Three

The trigger, this was developed by me, with pm assistance by Splitlink, thanks mate :clap:

The practical theory of the three keys will be the next post, showing the method rules in full and a chart example so you can follow it in the market next week.