leovirgo

Senior member

- Messages

- 3,161

- Likes

- 156

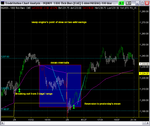

Here I will post buy sell signals genertated from my own VWAP ENGINE. It will be fully automated in a few days' time and here is today's chart.

It produced a total of 3 trades today- of which 2 were winners - second trade ( a loss ) was due to programming glitch which had been corrected.

Essence of the engine is -

- Buy above VWAP

- Sellshort below VWAP

if cycles permitted.

It produced a total of 3 trades today- of which 2 were winners - second trade ( a loss ) was due to programming glitch which had been corrected.

Essence of the engine is -

- Buy above VWAP

- Sellshort below VWAP

if cycles permitted.

Attachments

Last edited by a moderator: