This is just for a bit of fun, really.

I opened up an account with oanda last wednesday with £150. Obviously I cant expect to generate any sort of income with an account that size so i decided to try and turn that account into enough money to pay for my spending money for when i go away in the summer on a boys holiday! (or go bust!!!)

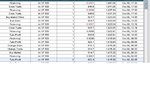

I am trading tiny stakes. usually around 1000 units which is around 5p per point?

Due to the mad volatility in recent days I have managed to make 790 pips.

The account now stands at around £190

I will update whenever a reasonable move in my equity takes place (good or bad)

I opened up an account with oanda last wednesday with £150. Obviously I cant expect to generate any sort of income with an account that size so i decided to try and turn that account into enough money to pay for my spending money for when i go away in the summer on a boys holiday! (or go bust!!!)

I am trading tiny stakes. usually around 1000 units which is around 5p per point?

Due to the mad volatility in recent days I have managed to make 790 pips.

The account now stands at around £190

I will update whenever a reasonable move in my equity takes place (good or bad)