DAX30DayTrader

Well-known member

- Messages

- 474

- Likes

- 51

Hi, I'm Nick Powell, my introduction located here: http://www.trade2win.com/boards/new-trade2win/2180-introduce-yourself-1082.html#post2199604

I have decided to start this diary to document and record my sucsess and failures as well as progress as a full time DAX day trader. The purpose is so that I can publicly record my own trading habits (good or bad) and maybe learn from any mistakes I make or from any weaknesses that others may point out. The other purpose is to attempt to provide an interesting read for fellow DAX traders or traders in general.

Each day that I trade the DAX, I will make a post in the morning detailing the support and resistance levels that I have found and will be watching during the day and any possible scenarios that I will be looking for. In terms of making trading decisions, I use 3 strategies...

In terms of risk, I tend to always risk 3% of my account on each trade with a view of making 3% or more in return. If I don't see at least a 1:1 possibility on a trade, then I will not take the trade. I normally only take 1 or 2 trades per day, very very rarely will I place 3 trades and almost never more than 3 trades. In fact, I can't even remember the last time I had 3 trades in one day.

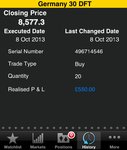

My trading style is day trading, I never hold positions over night and I never hold them beyond the DAX cash close. In fact most of my trades are entered and closed before the U.S opens up in the afternoon. The market that I trade is the DAX30 cash which is located on all of the financial spread betting platforms, the spread I have on my provider is 1 point.

At the end of each day I will post my diary of the days action and what trades I took along with my reasons and thoughts, I will also post a screen shot of my charts to accompany my postings.

Nick

I have decided to start this diary to document and record my sucsess and failures as well as progress as a full time DAX day trader. The purpose is so that I can publicly record my own trading habits (good or bad) and maybe learn from any mistakes I make or from any weaknesses that others may point out. The other purpose is to attempt to provide an interesting read for fellow DAX traders or traders in general.

Each day that I trade the DAX, I will make a post in the morning detailing the support and resistance levels that I have found and will be watching during the day and any possible scenarios that I will be looking for. In terms of making trading decisions, I use 3 strategies...

- The opening range (not the traditional way of trading this)

- A reversal/bounce strategy

- Divergence at support/resistance levels

In terms of risk, I tend to always risk 3% of my account on each trade with a view of making 3% or more in return. If I don't see at least a 1:1 possibility on a trade, then I will not take the trade. I normally only take 1 or 2 trades per day, very very rarely will I place 3 trades and almost never more than 3 trades. In fact, I can't even remember the last time I had 3 trades in one day.

My trading style is day trading, I never hold positions over night and I never hold them beyond the DAX cash close. In fact most of my trades are entered and closed before the U.S opens up in the afternoon. The market that I trade is the DAX30 cash which is located on all of the financial spread betting platforms, the spread I have on my provider is 1 point.

At the end of each day I will post my diary of the days action and what trades I took along with my reasons and thoughts, I will also post a screen shot of my charts to accompany my postings.

Nick

Last edited by a moderator: