Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

In order to keep things easy to find this thread is intended for posting any tools for use in the various strategies.

Respectfully request that the thread only contains the tools and not other comments, thanks etc. otherwise we'll end up with a ladies handbag instead of a tool box 🙂

Below are links to Position Size ElS and ELA code as approved by Grey1.

*** Correction - for latest version please see later post #3 **********

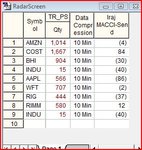

This code can be used for Scalping, Day-trading a few stocks at the same time, or Swing Trading a portfolio.

It is important to set the Inputs and the Data Compresssion to correct values in relation to

- what type of trade you are doing,

- how much capital you allocate to this type of trade,

- what percentage of capital you wish to risk i.e. Money Management Stop loss.

(The code uses Fixed Percentage Money Management)

- how many stocks to trade in a basket or portfolio,

- how you eliminate stocks with low ATR's which are not volatile enough to trade intraday..

Please refer to the notes in the code.

The code is not protected in case I need to make any changes, which I will post and then users can amend accordingly.

Hopefully there won't be too many queries 🙂

Glenn

Respectfully request that the thread only contains the tools and not other comments, thanks etc. otherwise we'll end up with a ladies handbag instead of a tool box 🙂

Below are links to Position Size ElS and ELA code as approved by Grey1.

*** Correction - for latest version please see later post #3 **********

This code can be used for Scalping, Day-trading a few stocks at the same time, or Swing Trading a portfolio.

It is important to set the Inputs and the Data Compresssion to correct values in relation to

- what type of trade you are doing,

- how much capital you allocate to this type of trade,

- what percentage of capital you wish to risk i.e. Money Management Stop loss.

(The code uses Fixed Percentage Money Management)

- how many stocks to trade in a basket or portfolio,

- how you eliminate stocks with low ATR's which are not volatile enough to trade intraday..

Please refer to the notes in the code.

The code is not protected in case I need to make any changes, which I will post and then users can amend accordingly.

Hopefully there won't be too many queries 🙂

Glenn

Attachments

Last edited: