You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

numbertea

Well-known member

- Messages

- 257

- Likes

- 9

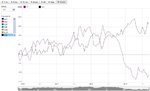

automated finally for ES

Based on my Bid Ask Market Sympathy indicator here is my entry for a nice trade day. The first two were winners and the dojis being traded on at the end were losers but immediately were exited as you can see.

To explain, the orange 'O's are where I am long and the purple 'X's are where I am short. It is a real time system so the entries and exits are on the open of the first bar after the signal to get in or out. These are 5 minute bars.

Thanks for your consideration.

Cheers

Based on my Bid Ask Market Sympathy indicator here is my entry for a nice trade day. The first two were winners and the dojis being traded on at the end were losers but immediately were exited as you can see.

To explain, the orange 'O's are where I am long and the purple 'X's are where I am short. It is a real time system so the entries and exits are on the open of the first bar after the signal to get in or out. These are 5 minute bars.

Thanks for your consideration.

Cheers

Attachments

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Here's our first trading game thread for week 1 of our October Contest.

'The Trading Game' is a monthly game split into weeks. Each week players post on that week's game thread an actual trade they made that week. Members vote on the trades they like using the 'like' button. At the end of the week the top 5 trades with the most votes win points. At the end of the month, all the points from all the players are counted up and the top 3 players each win an Amazon Voucher.

This month's contest will last 5 weeks and end on Friday, 1st November.

Want to know more? Check out all the details here:

http://www.trade2win.com/boards/t2w-announcements/179522-trading-game.html

Let the game commence... good luck all! 👍

I should have read it more carefully imo.

I was thinking it was meant to be a trade started at the time of posting. Zo it seems we can wait for a winning trade and then post it.

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

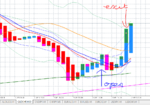

Limit Order placed to SELL NZDJPY @ 81.60, Tgt @ 78.60, SL @ 82.60

Current price NZDJPY @ 81.057 - as of Sunday evening 6th October.

Daily chart indicators show over-sold so expecting some bounce. Over long time frame (since September) JPY depreciation is over-cooked imo. So expecting some convergence as per diag.

Current price NZDJPY @ 81.057 - as of Sunday evening 6th October.

Daily chart indicators show over-sold so expecting some bounce. Over long time frame (since September) JPY depreciation is over-cooked imo. So expecting some convergence as per diag.

Attachments

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Here's an outline plan for one on Monday.

WPP is a gappy beast, though, so what it will look like after the open is anyone's guess. Will decide then.

opened 10 pt gap and quick to new low with market. Held vs FTSE then and I've put in a small taster (quarter position) as it went green above open at 1252.63. Doing this on SB where 3 point spread a bit of a bummer 😆

Stop 1235

Attachments

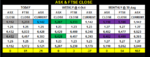

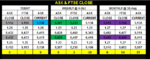

Looking for Tuesday trade in Aus /Asia

Short ASX and long FTSE.

Looking for daily variance of 40 and weekly variance close to zero.

My guess will be taken in first 30 mins of Sydney open or Hong Kong open.

Stop will be 4 to 11 hours, depends on when or if trade taken.

Short ASX and long FTSE.

Looking for daily variance of 40 and weekly variance close to zero.

My guess will be taken in first 30 mins of Sydney open or Hong Kong open.

Stop will be 4 to 11 hours, depends on when or if trade taken.

Attachments

Just back from Asia for 4 day's then off again

Short DAX 8,618 (SB current price) - stop 8,800 aim 8,200 to 8,300 before month end.

Just need the US to start defaulting on the loans.

It's only a game.

Stop to B/E

Could get taken out with US shut down resolution.

But the more it drags the lower it should go.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

opened 10 pt gap and quick to new low with market. Held vs FTSE then and I've put in a small taster (quarter position) as it went green above open at 1252.63. Doing this on SB where 3 point spread a bit of a bummer 😆

Stop 1235

actually got filled @ 1249.62 so bit over 10 to the good at the close.

i'd normally take stop off overnight and replace with a pro-rata FTSE hedge, but haven't got enough on for that so will just live with the hard stop and trust that the opening shenanigans don't catch me.

will look to add tomorrow if i can

VielGeld

Experienced member

- Messages

- 1,422

- Likes

- 179

I should have read it more carefully imo.

I was thinking it was meant to be a trade started at the time of posting. Zo it seems we can wait for a winning trade and then post it.

Tbh, I think this thread should only be composed of live calls. It's too easy to just say "hey, I made this great trade this week!" when there's no way to verify such a claim. I think we can all agree that making live calls would confer a degree of integrity to this contest.

Thoughts?

Sharky

Staff

- Messages

- 5,957

- Likes

- 618

Yeah, check out the rules here:

http://www.trade2win.com/boards/t2w-announcements/179522-trading-game.html

The entry should be posted BEFORE it's taken (or perhaps you think it's okay to post the trade IMMEDIATELY after taking it?)

http://www.trade2win.com/boards/t2w-announcements/179522-trading-game.html

The entry should be posted BEFORE it's taken (or perhaps you think it's okay to post the trade IMMEDIATELY after taking it?)

VielGeld

Experienced member

- Messages

- 1,422

- Likes

- 179

Ah, it's already a rule. That's cool, then. 🙂

I think it's preferable to state things in this thread prior to a trade if possible, but I'm also ok with giving a small margin of error as the market won't generally move that much. Though for periods of high volatility like a news item, I think the trade must be called in advance or it's nulled.

I think it's preferable to state things in this thread prior to a trade if possible, but I'm also ok with giving a small margin of error as the market won't generally move that much. Though for periods of high volatility like a news item, I think the trade must be called in advance or it's nulled.

numbertea

Well-known member

- Messages

- 257

- Likes

- 9

Ah, it's already a rule. That's cool, then. 🙂

I think it's preferable to state things in this thread prior to a trade if possible, but I'm also ok with giving a small margin of error as the market won't generally move that much. Though for periods of high volatility like a news item, I think the trade must be called in advance or it's nulled.

Guess I'm out of the competition then, good luck to all of you.

Cheers

Looking for Tuesday trade in Aus /Asia

Short ASX and long FTSE.

Looking for daily variance of 40 and weekly variance close to zero.

My guess will be taken in first 30 mins of Sydney open or Hong Kong open.

Stop will be 4 to 11 hours, depends on when or if trade taken.

Over night set up not right.

Attachments

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

.........will look to add tomorrow if i can.........

Holding off. No sense in trying to buck a weak market (although WPP tried to begin with) so waiting for the tide to turn. Still in the green, though, albeit by a whisker 😆

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

usd/jpy may be at "C" in the andrews pitchfork formation with the last low at 96.56..the targ is around 99.40

the price to watch imo is 97.07 ...the current price is 97.21 so could be low risk long using 97.07 as stop or 96.55 for the brave 🙂

not trading this just sharing chart/method so just ignore if it doesn't fit the rules🙂

the price to watch imo is 97.07 ...the current price is 97.21 so could be low risk long using 97.07 as stop or 96.55 for the brave 🙂

not trading this just sharing chart/method so just ignore if it doesn't fit the rules🙂

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

lets roll

I'l l take my GBPUSD sell trade - entered at around 1.5986 ....see reasons here

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1492.html#post2200854

lets take a S/L at 6127 as shown ........and the hell just let it run to EOW.........I think its gonna be a big move this week

N

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1492.html#post2200854

I'l l take my GBPUSD sell trade - entered at around 1.5986 ....see reasons here

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1492.html#post2200854

lets take a S/L at 6127 as shown ........and the hell just let it run to EOW.........I think its gonna be a big move this week

N

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1492.html#post2200854

Attachments

Similar threads

- Replies

- 44

- Views

- 13K

- Replies

- 18

- Views

- 7K