Hello,

I am a complete newbie to trading. I'm under no illusion otherwise.

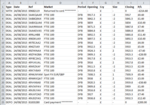

I've been day trading the FTSE100 on my IG index demo account for the last week or so. I'm currently about £25,000 Demo money up.

There must be something I am missing, that I'd like clarified. I've been trading huge amounts per point. Approx £500 - with the fluctuation of the FTSE100 these almost immediately change huge amounts, seeing -£4,000 is not uncommon. However, never have I had a trade that hasn't fluctuated up a little, with me closing the spread usually around £900 in profit (only a point or two up)

My question is this, I have very rarely seen the spread go below say, -£6,000 (once or twice) and have closed every single trade at a profit (of a few hundred pounds).

With a balance of £50k or so, would the above not be a feasible strategy? One could even set a stop at -£15k or so to prevent anything seriously bad happening (though I haven't seen that in the last 2 weeks (200 trades or so))

I welcome you all to tell me how wrong I am.

Cheers,

Matt

I am a complete newbie to trading. I'm under no illusion otherwise.

I've been day trading the FTSE100 on my IG index demo account for the last week or so. I'm currently about £25,000 Demo money up.

There must be something I am missing, that I'd like clarified. I've been trading huge amounts per point. Approx £500 - with the fluctuation of the FTSE100 these almost immediately change huge amounts, seeing -£4,000 is not uncommon. However, never have I had a trade that hasn't fluctuated up a little, with me closing the spread usually around £900 in profit (only a point or two up)

My question is this, I have very rarely seen the spread go below say, -£6,000 (once or twice) and have closed every single trade at a profit (of a few hundred pounds).

With a balance of £50k or so, would the above not be a feasible strategy? One could even set a stop at -£15k or so to prevent anything seriously bad happening (though I haven't seen that in the last 2 weeks (200 trades or so))

I welcome you all to tell me how wrong I am.

Cheers,

Matt