‘The proper execution of your trades is one of the most fundamental components of becoming a successful trader and probably the most difficult to learn. Most traders find it is much easier to identify something in the market that represents an opportunity, than it is to act upon it.’

Mark Douglas

If we consider that the two key variables to achieving trading profitability are having a trading strategy with edge and a positive expectancy combined with the ability to consistently execute that strategy, then assuming a trader has the first one (and developing this is a primary concern) then it is the consistency of execution that becomes the key focus.

| Trading Success Formula Trading Strategy With Edge + Ability To Be Able To Execute It Consistently /Positive Expectancy |

In my work with traders I have seen many traders who do not have the first ingredient in place and this is the primary cause of their lack of trading success and also the emotional challenges that they have experienced. Of the traders who have a positive expectancy system there are some who find the consistent execution challenging, particularly in specific situations such as during a period of drawdown or after a string of successes.

One of the key aspects that seems to distract traders is excessive focus on P&L and the outcome and results of the trade. That is the trader is so distracted by thoughts around outcome and money to be made/lost that they do not have sufficient focus on the key components of executing their trade to achieve the best outcome. Likewise traders who are low in confidence fail to execute their trades and take opportunities when they arise losing valuable potential profits.

To help with the above two challenges I encourage the traders that I work with to focus on the flawless execution of their trading strategy as opposed to overly focusing on P&L and results.

In the trading process we have 5 core components:

1. Monitor – watching the markets

2. Spot – spotting a trading opportunity

3. Enter – enter the market, place the trade

4. Manage – management of the position

5. Exit - exit the market, close the trade

In flawless execution the trader focuses on the process of each of the 5 steps and aims to do each one as well as they possibly can. This pre-supposes that the trader is aware of the 5 stages and knows what the core components for each stage are in relation to their trading approach/strategy. Essentially they then evaluate their trading performance against the quality of their execution of the trade alongside it’s profitability. This is a critical mental shift. The trader is assessing their performance against the criteria of ‘How well have I traded?’ alongside or instead of ‘How much money have I made!’ This is not always an easy shift to make, but is a powerful one – away from P&L and towards process and performance. It is interesting to note that this is exactly the same approach taken by elite sports people and high performers across many fields – a shift of focus away from outcome and towards process; it is important to be aware of the fact that in cases of ‘choking’ (poor performance under pressure) this is often attributed to a shift in focus – you guessed it, away from process and towards outcome! Fear, anxiety and greed are all linked into a monetary focus and in many cases an underperformance as a trader.

I have worked with many traders who have struggled with their trade execution, but thankfully there are many practical approaches that can be taken that can help to improve this situation quite dramatically. There are three key factors that enable flawless execution – confidence, focus and discipline. By developing these three areas, and shifting your mindset to that of ‘flawless execution’ you may find that the quality of your trading improves and you experience less high negative emotional states such as fear and anxiety.

Below are the three areas, and some bullet point reminders that you can take away and implement within your own trading.

Confidence

- Profitable Trading Strategy With Edge In The Market (Positive Expectancy)

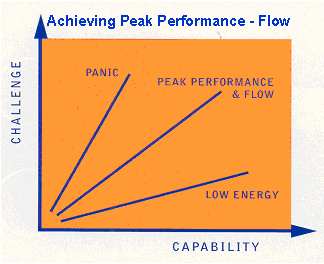

- Trade In Line With Your Current Ability Level – recognize where you are (beginner, novice, competent, expert, master) and trade an approach that is appropriate for your level of skill, knowledge and understanding. Anxiety and fear increase and confidence decreases when we are exposed to challenges that are too great for our perceived capabilities (see chart of ‘challenge v capability’

- Trading In Line With Your Strengths, Interests and Best Potential For Profitability

Focus

- Process – focus on quality execution of each of the five stages of the trade model

- Controllables – only aim to control what you can control! Recognise that some factors are outside of your control – namely the markets! Place your time and energy into aspects of your trading that you control – what you trade/when you trade/how you trade/why you trade etc

- In The Present Moment – thoughts about the past and the future are not helpful in the moments of execution. Keep your attention in the now. Try this – get a ball or similar; throw it in the air; catch it. When the ball was in the air what were you focused on? Catching the ball hopefully! Not dropping it, or the shopping, or what you will be wearing tomorrow – your attention was in the moment.

Discipline

- Be Prepared – before every trading session. Develop a pre-trading preparation routine for yourself to help you to get into the zone! Having a period of preparation is useful at many different levels including helping you to manage market risk by being aware of economic releases/earnings announcements/speakers etc; enabling you to focus on your trading strategy and perhaps engaging in some mental rehearsal; enabling the transition from your previous state/mindset into your trader state/mindset.

- Trade In Positive States – tiredness, anger, frustration, stress are all states that are limiting to you trading to your full potential. Aim to trade when you are at your best, or close too!

- Take Appropriate Risk– high risk creates high emotion and specifically fear and anxiety in many traders. Low risk trading in line with your own threshold, trading capital and personal wealth makes for a less emotional more confident trading experience.

In summary, the goal of trading should perhaps be consistent high level execution (flawless execution) of the trading strategy, based on the presupposition that a positive expectancy trading strategy is in place. Trading is often referred to as being simple but not easy and this may be the result of the challenge of being able to develop the required level of consistency in execution. By working at both developing your trading strategy and your trading execution you will over time see improvements to your trading performance.

Take a look back at some of the practical strategies that have been provided in this article. Which could you utilize to enhance your trading performance? When will you take action and implement? What will the benefits be for you?

Remember that there are no quick fix solutions to becoming a better trader, but by implementing consistently practical and proven strategies you can develop your trading performance and move closer towards the achievement of your trading goals.

Last edited by a moderator: