BeginnerJoe

Senior member

- Messages

- 3,329

- Likes

- 351

I found it annoying with some recent threads where noobies were crying about their bucketshop doing this, or their broker doing that, blah, blah, blah. When the issue is really the noobies themselves have absolutely zero awareness of what is actually going on in the market.

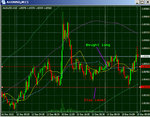

So here's a little lesson for them based on my latest failed trade. Basically, I placed a trade and decided to go to sleep. I randomly choose a stop loss level knowing roughly there was a good chance it would be knocked out. When I woke up and checked, it was knocked out, and knocked out with great surgical precision. This was nothing new because it happened 100's if not 1000's of times in the past.

So why do things like that happen ? Very simple, the scum on the other side of my trade is making a profit. Is it wrong for him/it to do so ? No, because this is how the market works, it makes profits from you if it can and if you let it.

Although possible, I don't believe my broker was responsible for knocking out my trade because they could just be a middle man in a whole chain of people involved in this trade. I believe the guy at the end of this chain is the one moving prices and making profits. Generally, although possible, I don't believe bucketshops need to do the hard work in moving prices when they can just make easy money collecting commissions.

Some will say: no way man, they have to trade billions worth contracts to move the prices to take you out. Actually I believe they can do it quite easily and for free because those contracts are just fluff and from the same scum at the end of the chain for my order.

Some others will say: ahh, your stop was at the same place as many other stops, that's why you got taken out. From experience, I know this to be untrue. Because my stops are often random and the type of (sharp touch and reverse) surgical strike illustrated would occur on them regardless of where my stops were.

Anyway my small loss was easily recovered. While I am awake and watching, this kind of price play by the market is no longer effective against me.

So here's a little lesson for them based on my latest failed trade. Basically, I placed a trade and decided to go to sleep. I randomly choose a stop loss level knowing roughly there was a good chance it would be knocked out. When I woke up and checked, it was knocked out, and knocked out with great surgical precision. This was nothing new because it happened 100's if not 1000's of times in the past.

So why do things like that happen ? Very simple, the scum on the other side of my trade is making a profit. Is it wrong for him/it to do so ? No, because this is how the market works, it makes profits from you if it can and if you let it.

Although possible, I don't believe my broker was responsible for knocking out my trade because they could just be a middle man in a whole chain of people involved in this trade. I believe the guy at the end of this chain is the one moving prices and making profits. Generally, although possible, I don't believe bucketshops need to do the hard work in moving prices when they can just make easy money collecting commissions.

Some will say: no way man, they have to trade billions worth contracts to move the prices to take you out. Actually I believe they can do it quite easily and for free because those contracts are just fluff and from the same scum at the end of the chain for my order.

Some others will say: ahh, your stop was at the same place as many other stops, that's why you got taken out. From experience, I know this to be untrue. Because my stops are often random and the type of (sharp touch and reverse) surgical strike illustrated would occur on them regardless of where my stops were.

Anyway my small loss was easily recovered. While I am awake and watching, this kind of price play by the market is no longer effective against me.

Attachments

Last edited: