You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

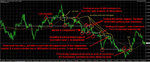

Does anyone use a 50SMA retracing method where you wait for the price to cross, then on the next retrace you buy or short accordingly? Just wondering whether successful or not.

An example 1 hr chart attached (yellow 50 SMA, red 200SMA)

I'd bet, dollars to doughnuts, that you can't make CONSISTENT money using this method because it is basically accurate only 50% of the time.

I'd bet, dollars to doughnuts, that you can't make CONSISTENT money using this method because it is basically accurate only 50% of the time.

50% is a perfect amount to make money as long as you target profit is double your stop loss. The trick, I guess is getting the SL right and only seems to work in a trending market. I do know of some traders that use but on a different pair.

Yes, the exit you would have gone short and been stopped out but that serves as an exit I guess - just not a profitable one 😉

Oh...the slope of the 50EMA has to be one way or the other, just not flat to take a trade.

Yes, the exit you would have gone short and been stopped out but that serves as an exit I guess - just not a profitable one

Fair point !

GladiatorX

Established member

- Messages

- 905

- Likes

- 119

I strongly recommend that you don't use this strategy to trade. It doesn't work in choppy markets. Markets chop 75% of the time... You can say 'identify trending markets then' but then they're are better ways to trade trending markets so... Basically you'll lose money doing this, my friend did it on FX for 6 months demo and theoritically lost money following rules strictly with good MM, he is a good trader too, trades futures for a living so he knows what he is doing...

Don't even bother, find something else.

Don't even bother, find something else.

I strongly recommend that you don't use this strategy to trade. It doesn't work in choppy markets. Markets chop 75% of the time... You can say 'identify trending markets then' but then they're are better ways to trade trending markets so... Basically you'll lose money doing this, my friend did it on FX for 6 months demo and theoritically lost money following rules strictly with good MM, he is a good trader too, trades futures for a living so he knows what he is doing...

Don't even bother, find something else.

When you say choppy, do you mean ranging?

To be honest, I'm more of a support and resistance trader plus breakout trading but this looked interesting if used in conjunction with S&R and candle patterns.

A choppy market, if that means ranging, I would probably just trade with S&R.

Did he use any extra filters like only short if the price is below 50SMA and 200SMA, only long if above both, wait for candle to touch line then entry 25-50 pips above the SMA, etc.

Last edited:

shadowninja

Legendary member

- Messages

- 5,524

- Likes

- 645

When it's ranging, you're gonna be giving your profits back. Look for times when it keeps crossing the line. How can you avoid trading these times?

When it's ranging, you're gonna be giving your profits back. Look for times when it keeps crossing the line. How can you avoid trading these times?

Well, it seems to work best when the angle of the SMA is near 45 degrees, when the market is ranging, the SMA will be flat therefore no trade. You could combine it with an ADX indicator maybe but it's easy to see if the market is ranging.

Also I believe one of the MM rules for this is to take half your position off at say 50 to 100 pips and let the rest run whilst moving your stop to break even.

The trend on the 4hr charts is important as well.

Last edited:

Does anyone use a 50SMA retracing method where you wait for the price to cross, then on the next retrace you buy or short accordingly? Just wondering whether successful or not.

An example 1 hr chart attached (yellow 50 SMA, red 200SMA)

That's a trend following method, surprisingly successful. I don't use 50MA (thank God that we are all different) but I do use the method, along with other things.

Be careful of whipsaws. That is my word of advice.

I step out of a trade when I think that the market is over bought/sold and I don't try to get clever with countertrends, etc. Take the money, step back and examine the action.

You could have a period of contraction for lots of bars, depending on the TF you use and that contraction period will whipsaw all your profit away if you are not careful.

Good trading

Afterthought: How did you know to exit when you did? Looks like a bit of hindsight, to me. Try incorporating a channel of some kind so that you get out when you are overbought/sold

That's a trend following method, surprisingly successful. I don't use 50MA (thank God that we are all different) but I do use the method, along with other things.

Be careful of whipsaws. That is my word of advice.

I step out of a trade when I think that the market is over bought/sold and I don't try to get clever with countertrends, etc. Take the money, step back and examine the action.

You could have a period of contraction for lots of bars, depending on the TF you use and that contraction period will whipsaw all your profit away if you are not careful.

Good trading

Afterthought: How did you know to exit when you did? Looks like a bit of hindsight, to me. Try incorporating a channel of some kind so that you get out when you are overbought/sold

I didn't. The exit was an exit by being stopped out so lost a bit of profit.

I would probably only go with the 4hr trend with this, ie if 4hr trend is down and 50SMA on the 1hr is down then SELL.

What do you mean by contraction? Do you mean a period where it just stays at or around the SMA? As long as your stop loss is correct that shouldn't cause a problem but that's why candle patterns are also important in this because price doesn't always touch the SMA, it might come very close.

What EMA or SMA do you use and do you define the trend in the same way? ALso, how do you judge for whipsaws? Presumably, a whipsaw is when it goes above the EMA and then comes back in line with the trend anyway.

When you say channel, do you mean some kind of envelope or bollinger band? I don't really trust bollinger bands as they expand. I trust an envelope more but the standard deviation is always based on the last high or low. eg. 21EMA envelope with 1% standard deviation based on the last high.

jimbotrader

Junior member

- Messages

- 24

- Likes

- 2

Does anyone use a 50SMA retracing method where you wait for the price to cross, then on the next retrace you buy or short accordingly? Just wondering whether successful or not.

I use a 49SMA so I can be faster than you.

Give us a retrace...

I didn't. The exit was an exit by being stopped out so lost a bit of profit.

I would probably only go with the 4hr trend with this, ie if 4hr trend is down and 50SMA on the 1hr is down then SELL.

What do you mean by contraction? Do you mean a period where it just stays at or around the SMA? As long as your stop loss is correct that shouldn't cause a problem but that's why candle patterns are also important in this because price doesn't always touch the SMA, it might come very close.

What EMA or SMA do you use and do you define the trend in the same way? ALso, how do you judge for whipsaws? Presumably, a whipsaw is when it goes above the EMA and then comes back in line with the trend anyway.

When you say channel, do you mean some kind of envelope or bollinger band? I don't really trust bollinger bands as they expand. I trust an envelope more but the standard deviation is always based on the last high or low. eg. 21EMA envelope with 1% standard deviation based on the last high.

A contraction is, for me, when the price reverses lots of times, gradually nearing the average. That is where there are whipsaws and when I see one. I don't want to know.

A channel can be an average band (say, 2%) around the average that you use, or one around a trendline, just something to give you an idea where oversold is. I think that taking that kind of profit is better than having a stop on the average, like you had. Let's face it, that average was where you were considering an entry, so why put a stop there?

Also, it's taken a long time before you finally got stopped out. Too long, for me.

Bollingers can be bouncers or the start of a new trend. They have to be treated with caution, like everything else.

How do I define a trend? I look at it on the chart and decide what it is by eye. The averages that I use are the ones that I like for that chart.

timsk

Legendary member

- Messages

- 8,837

- Likes

- 3,538

Hi SanMig',

I've recently been embroiled in a heated debate on another thread about price finding support or resistance (S&R) at MA's and trendlines. I'm not in a hurry to repeat the exercise as most people are of the view that they do indeed act as S&R. Each to their own. However, I maintain that price isn't in the least bit interested in trendlines and MA's, not least because where you draw or plot yours will be different to where I draw and plot mine. Add into the mix that let's say you use OHLC prices and work of hourly charts where as I use line charts based on close only prices - and you can soon see that trendlines and MA's will be in different places giving different signals on our respective charts. 'Jimbotrader' makes a joke about plotting a 49 MA and being in or out quicker than you and, believe it or not, some traders really do believe that! (Although I suspect Jimbotrader isn't one of them, lol.) Areas of S&R on the other hand don't change because, unlike indicators (MA's and trendlines are indicators after all), they are based on real emotional events. Namely; market participants buying and selling and, in the process, making or losing money. Here's a simple question for you. . . Which is more significant:- a bunch of lines on a chart (which vary from chart to chart) or clearly defined points in the same place on ALL charts (be they line, OHLC, or P&F etc.) across most timeframes, where market players made or lost a ton of money? If you subsribe to the idea that price charts reflect human fear and greed and the best places to observe these emotions is around areas of S&R, you will be one giant step ahead of the majority of other traders. If, on the other hand, you cling to the belief that the former is more significant than the latter, then good luck to you. At least you are on the side of the majority! However, you will find that 90% of the time, where price magically seems to find S&R at the MA's, lo and beyold - it turns out to be a key area of S&R. I've annotated your chart to show that all the areas you circled are in fact key areas of S&R. I put it to you that this is the real reason why price reacted the way it did and not because of some arbitrarily drawn trendline or MA.

Tim.

I've recently been embroiled in a heated debate on another thread about price finding support or resistance (S&R) at MA's and trendlines. I'm not in a hurry to repeat the exercise as most people are of the view that they do indeed act as S&R. Each to their own. However, I maintain that price isn't in the least bit interested in trendlines and MA's, not least because where you draw or plot yours will be different to where I draw and plot mine. Add into the mix that let's say you use OHLC prices and work of hourly charts where as I use line charts based on close only prices - and you can soon see that trendlines and MA's will be in different places giving different signals on our respective charts. 'Jimbotrader' makes a joke about plotting a 49 MA and being in or out quicker than you and, believe it or not, some traders really do believe that! (Although I suspect Jimbotrader isn't one of them, lol.) Areas of S&R on the other hand don't change because, unlike indicators (MA's and trendlines are indicators after all), they are based on real emotional events. Namely; market participants buying and selling and, in the process, making or losing money. Here's a simple question for you. . . Which is more significant:- a bunch of lines on a chart (which vary from chart to chart) or clearly defined points in the same place on ALL charts (be they line, OHLC, or P&F etc.) across most timeframes, where market players made or lost a ton of money? If you subsribe to the idea that price charts reflect human fear and greed and the best places to observe these emotions is around areas of S&R, you will be one giant step ahead of the majority of other traders. If, on the other hand, you cling to the belief that the former is more significant than the latter, then good luck to you. At least you are on the side of the majority! However, you will find that 90% of the time, where price magically seems to find S&R at the MA's, lo and beyold - it turns out to be a key area of S&R. I've annotated your chart to show that all the areas you circled are in fact key areas of S&R. I put it to you that this is the real reason why price reacted the way it did and not because of some arbitrarily drawn trendline or MA.

Tim.

Attachments

shadowninja

Legendary member

- Messages

- 5,524

- Likes

- 645

Well, it seems to work best when the angle of the SMA is near 45 degrees, when the market is ranging, the SMA will be flat therefore no trade. You could combine it with an ADX indicator maybe but it's easy to see if the market is ranging.

Also I believe one of the MM rules for this is to take half your position off at say 50 to 100 pips and let the rest run whilst moving your stop to break even.

The trend on the 4hr charts is important as well.

It can work this way. You need to test it with a small live account, then.

Hi SanMig',

I've recently been embroiled in a heated debate on another thread about price finding support or resistance (S&R) at MA's and trendlines. I'm not in a hurry to repeat the exercise as most people are of the view that they do indeed act as S&R. Each to their own. However, I maintain that price isn't in the least bit interested in trendlines and MA's, not least because where you draw or plot yours will be different to where I draw and plot mine. Add into the mix that let's say you use OHLC prices and work of hourly charts where as I use line charts based on close only prices - and you can soon see that trendlines and MA's will be in different places giving different signals on our respective charts. 'Jimbotrader' makes a joke about plotting a 49 MA and being in or out quicker than you and, believe it or not, some traders really do believe that! (Although I suspect Jimbotrader isn't one of them, lol.) Areas of S&R on the other hand don't change because, unlike indicators (MA's and trendlines are indicators after all), they are based on real emotional events. Namely; market participants buying and selling and, in the process, making or losing money. Here's a simple question for you. . . Which is more significant:- a bunch of lines on a chart (which vary from chart to chart) or clearly defined points in the same place on ALL charts (be they line, OHLC, or P&F etc.) across most timeframes, where market players made or lost a ton of money? If you subsribe to the idea that price charts reflect human fear and greed and the best places to observe these emotions is around areas of S&R, you will be one giant step ahead of the majority of other traders. If, on the other hand, you cling to the belief that the former is more significant than the latter, then good luck to you. At least you are on the side of the majority! However, you will find that 90% of the time, where price magically seems to find S&R at the MA's, lo and beyold - it turns out to be a key area of S&R. I've annotated your chart to show that all the areas you circled are in fact key areas of S&R. I put it to you that this is the real reason why price reacted the way it did and not because of some arbitrarily drawn trendline or MA.

Tim.

You are right. ma's are just a point on the chart where the trader may have decided to enter or leave a trade.

The same can be said for Bollingers, Fibs. trendlines and ---may I say it--- S&R horizontal lines.

The amount of discussion I read about where resistance or support is nobody's business.

One thing is certain, whether you, I or anyone else enters or leaves a trade and posts it, asking for a comment, you can be sure that there will be a series of posters arguing the toss about why, or why not, it was correct or incorrect.

S&R lines? They are all over the charts, on all timeframes and, when analised, are as big a piece of TA BS as everything else. So which is going to be the one?

Everything is coincidence on a chart. What happens is that so many traders use S&R lines that they become self fulfilling. But this, too, is the same with averages, trendlines, fibs, pivots and all the rest. But even if they use that line, there is no certainty that it is going to work. So I believe that all new traders should say "this chart is trending, so that is the direction that I should take" What tells you whether a price is trending or not? To me it is an average or a trendline, certainly not a S&R line, that does that. "Where should I leave or enter that trend line" When you ask yourself that question, the entry position on the average becomes obvious, to my mind.

50 - 50, well SanMiguel its rigth that these percentage is enough to make money depending on your strategy, in such a case wouldnt it be less stressfull and offer more fun to go to a sportsbook?, by the other hand you go short when it crosses, in a raging moment you can loose a lot. I dont use it, i preffer to use support and resistances and use 1 hr charts with some oscilators and a 40 SMA just to confirm short term trends.

Does anyone use a 50SMA retracing method where you wait for the price to cross, then on the next retrace you buy or short accordingly? Just wondering whether successful or not.

An example 1 hr chart attached (yellow 50 SMA, red 200SMA)

If you can make CONSISTENT money using this method, the more power to you and good luck.

However, it seems very probable that this method will get destroyed in a range- which happens often.

I agree that this is a very dangerous possibility. I try to take out a piece of trend running as profit and then leave it until the next day.

We all have our methods but trend following, to me, is much more logical than trying to spot the turns on SR lines.

Anyway, to each his own.

Everything works sometimes --nothing works always.

We all have our methods but trend following, to me, is much more logical than trying to spot the turns on SR lines.

Anyway, to each his own.

Everything works sometimes --nothing works always.

timsk

Legendary member

- Messages

- 8,837

- Likes

- 3,538

Hi Split'

Like I say, I'm not wanting to get into another argument!

I'm lost for words, other than to say that if you genuinely believe that zones of S&R are just 'as big a piece of TA BS as everything else' - you must have a torid time analysing a chart and deciding how to trade it!

Tim.

Like I say, I'm not wanting to get into another argument!

Traders 'may' have got into or out of trades at all the places you mention (and more besides) but not at S&R levels. There's no 'may' about it; they definitely got in or out at those levels which is another reason why they are so important and why the Fib's, Bolly Bands and MA's etc. are not as important. That's not to say that they don't have value and that traders can't use them to make money. They can. (Please forgive the triple negative!)You are right. ma's are just a point on the chart where the trader may have decided to enter or leave a trade.

The same can be said for Bollingers, Fibs. trendlines and ---may I say it--- S&R horizontal lines.

If you have any particular issue with my annotation on the OP's chart - especially if you think it's incorrect or flawed in any way - I'd be very interested to hear you views.The amount of discussion I read about where resistance or support is nobody's business.

One thing is certain, whether you, I or anyone else enters or leaves a trade and posts it, asking for a comment, you can be sure that there will be a series of posters arguing the toss about why, or why not, it was correct or incorrect.

😱S&R lines? They are all over the charts, on all timeframes and, when analised, are as big a piece of TA BS as everything else. So which is going to be the one?

I'm lost for words, other than to say that if you genuinely believe that zones of S&R are just 'as big a piece of TA BS as everything else' - you must have a torid time analysing a chart and deciding how to trade it!

'Everything is coincidence on a chart.' I'm even more shocked now! If you believe that, then it's not possible for you to form a view about what's happening from a chart and trade it accordingly. You can't take that view AND use charts to trade as the whole point about TA is that price movement isn't merely random.Everything is coincidence on a chart. What happens is that so many traders use S&R lines that they become self fulfilling. But this, too, is the same with averages, trendlines, fibs, pivots and all the rest. But even if they use that line, there is no certainty that it is going to work.

I agree that trendlines and MA's indicate whether an instrument is trending - or not. After all, that is their primary function. But, as you and others have commented already, they are of little use in non trending markets which, after all, is most markets most of the time. Traders who are good at identifying key areas of S&R will be ahead of the game because they will be able to spot an emerging trend long before the requisite number of HH's and HL's (in an uptrend) have been created to enable a trendline to be drawn.So I believe that all new traders should say "this chart is trending, so that is the direction that I should take" What tells you whether a price is trending or not? To me it is an average or a trendline, certainly not a S&R line, that does that. "Where should I leave or enter that trend line" When you ask yourself that question, the entry position on the average becomes obvious, to my mind.

Tim.

Similar threads

- Replies

- 0

- Views

- 1K

- Replies

- 47

- Views

- 21K