Brock Landers

Member

- Messages

- 90

- Likes

- 35

(lulz at title)

Right, in another thread a poster (who shall remain anonymous) asked for guidance on taking their trading to the next step. Said plonker had explored the basics of order types, order entry, and had fired off a few trades, but lacked a solid methodology for determing what and when to trade.

In an effort to offer assistance to someone looking for a few pointers, I made the following post:

... to which the Original Poster was most ungrateful for and reacted with disdain when informed of my ability to concentrate on more than one thing at once. Upon recieving this reaction, I removed my post, basically in an act of spite.

It has since been pointed out to me that other, more humble aspiring traders might in some small way benefit from what I had written. With regard to that, I reproduce my post here in full.

Right, in another thread a poster (who shall remain anonymous) asked for guidance on taking their trading to the next step. Said plonker had explored the basics of order types, order entry, and had fired off a few trades, but lacked a solid methodology for determing what and when to trade.

In an effort to offer assistance to someone looking for a few pointers, I made the following post:

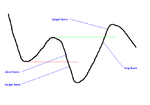

Brock Landers said:Here is a simple strategy for you to follow (see diagram). It is basically looking to profit from opportunities where the elasticity of supply is greater than the elasticity of demand (i.e. if it goes down, it will go down more than if it were to go up). This is because of order clusters around the level which, when breached, create a positive feedback loop (selling results in further selling).

Mark your levels out (the green and red lines) from one timeframe, and then examine the candlesticks on a lower timeframe as your levels are approached. Keep a record of a few metrics that you can easily track in a journal, and as each setup occurs, mark in your journal what the metrics are doing (for example, one metric might be to look at the speed at which the level has been approached, either by some rate-of-change indicator, or candlestick length. Another might be whether the price is above or below an opening range). Have a few, but no more than you can readily examine. I personally think volume is well worth following if you can get reliable data.

After a while, you will start to notice patterns among which trades have worked and which trades haven't. This is less to do with examining the records you have kept, and more to do with your sub-conscious memory giving you clues (see link). Some trades won't "feel right", some will, and it is this experience that you should look to develop over time.

In the first instance, this strategy will lose you money. I am sorry to say that turnkey trading strategies don't exist, and in the least you will be crossing spreads and paying commissions. This is the cost of your education - your P&L will resemble a J curve, if you have the necessary skills and dedication to see it through. Chopping and Changing strategies ad infinitum will never get you beyond the trough in the J, at some point you have to pick one and run with it.

Initially, have stops and targets calculated by some volatility measure; ATR is as good as any. Manage your risk with the knowledge that at this stage it is less about how much you make and pretty much exclusively about how little you can lose. A penny saved is a penny earned, and given that you will be losing money initially, loss minimising is a primary goal.

Aside from that, there are several books you can be reading to broaden your horizons. I personally would read two at a time, one technical and one psychological. To start you off, say, read a candlestick book by Steve Nison as your technical research and "remenicenses of a stock operator" for your psychological research.

Lastly, examine your lifestyle and make any changes to it that can improve your performance. Eat well, take regular exercise, make sure you are rested before approaching the market. Have a set time to trade in your day. Don't trade after you have had a fight with your girlfriend. Find 10 mins each day and practice breathing in for 5 seconds, and then out for 5 seconds. All these inches add up.

Al Pacino's Inspirational Speech - YouTube

good luck on your journey.

... to which the Original Poster was most ungrateful for and reacted with disdain when informed of my ability to concentrate on more than one thing at once. Upon recieving this reaction, I removed my post, basically in an act of spite.

It has since been pointed out to me that other, more humble aspiring traders might in some small way benefit from what I had written. With regard to that, I reproduce my post here in full.