Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

I bought this system 3rd May 2009 because I am a confirmed longer TF trader. Initially I wanted it because the author devised it specifically for taking advantage of LT trends. He runs a blog, and personally he prefers the 4H TF - and that's what he bases his published results on.

My idea was to trade the Daily candles, because I get home from my night shifts just before 2400 GMT (in Australia) and I have around one hour to review the charts before the candle closes, and the new one starts.

Ideal for me.

Problem: There were too few opportunities to enter the trends, once underway, and wanting to be a system purist, I faithfully stood by, watching lots of pips float past, while waiting for an entry. I took this up with the author, asking him if I was operating the method correctly, and he replied (within 2 hours) that yes, there was nothing wrong with my operation of his method.

I looked at what I was doing, and realised I could have entered at countless 4H intervals, and then stayed with these trends providing they were profitable, and in sync with the Daily charts. So today I am trading the 4H charts with good results.

I still have issues with trade management because of my night work - I can not adjust trades - enter/exit and so on because I am either at work or asleep at times signals occur that influence trade management. Fortunately, I am able to switch on my charts around the London market opening time and catch the activity until it is time for me to head out to work again. This satisfies my need to be involved during some activity, at least.

I submit that background to explain my situation. I also have a family I happen to wish to keep! 😀 😀

Essentialy what has happened is that I have been forced through my desire to get into the longer trends, to become a slightly shorter-term trader than I want to. Not too concerned - just that I am missing an occasional signal, and one way or the other, that has a cost.

Anyway - on to the method. I am unsure exactly how much information T2W allows members to put on the forum. For now I will not post any links - it is easy enough to Google the name and find out for yourself. I see other members do post links - whether rightly or not. The author has been selling the method for well over a year, and has a blog for detailing trades at the close of each month.

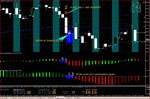

So - I have attached a pic of the template. From what I can gather he uses several indicators to arrive at a strong probability of the trade continuing to go in the direction of a confirmed trend. He syas he has written the method himself, and I can see this is probably true, except that I can see elements of the AO indicator, and a multi-time-frame ADX indicator, which I have seen elsewhere. (Copied from his?)

At this stage, I am purely in demo mode. Results have been good. Can not help tweaking the setup to personalise it a bit, and I think most traders would do that. But it does not alter the signals.

The usual up/down Green/Red arrows are used, as well as smaller white ones to signal the close of the current trade. You can exit on these, or prefer to exit at the Fibs Support/Resistance which is built-in.

The only changes I made to the template, were to add some colour to the candles, and to add Spuds MTF Stochastic, which, in my view should be in every trader's toolbox. I sometimes delete the ADR window from the chart, to improve viewable screen real estate. 🙂 I am attaching the original template - I can show the tweaks later.

I have been searching for a setup that gives me confidence that the trade will continue in the current direction for at least the next time period. Of course this is fairy-land stuff. It can never be guaranteed. But for me, I think this has the potential to elevate that probability. The addition of the MTF Stochastic enhances the probability of continuance. (Not shown)

The author's use of the MTF ADX also signals the continuance of trend, and i have found it to be reliable.

I should add that there are a few parameters that need to line up prior to pulling the trigger, as well as a need to be aware of whether the current TF is ranging or trending. That is important. If you kow the trend, and only trade in that direction, it helps! 😀

At times you can get a signal that is counter to the LT trend. Experienced traders can take those, but I prefer to wait until the trend is coming back to conformity.

My idea was to trade the Daily candles, because I get home from my night shifts just before 2400 GMT (in Australia) and I have around one hour to review the charts before the candle closes, and the new one starts.

Ideal for me.

Problem: There were too few opportunities to enter the trends, once underway, and wanting to be a system purist, I faithfully stood by, watching lots of pips float past, while waiting for an entry. I took this up with the author, asking him if I was operating the method correctly, and he replied (within 2 hours) that yes, there was nothing wrong with my operation of his method.

I looked at what I was doing, and realised I could have entered at countless 4H intervals, and then stayed with these trends providing they were profitable, and in sync with the Daily charts. So today I am trading the 4H charts with good results.

I still have issues with trade management because of my night work - I can not adjust trades - enter/exit and so on because I am either at work or asleep at times signals occur that influence trade management. Fortunately, I am able to switch on my charts around the London market opening time and catch the activity until it is time for me to head out to work again. This satisfies my need to be involved during some activity, at least.

I submit that background to explain my situation. I also have a family I happen to wish to keep! 😀 😀

Essentialy what has happened is that I have been forced through my desire to get into the longer trends, to become a slightly shorter-term trader than I want to. Not too concerned - just that I am missing an occasional signal, and one way or the other, that has a cost.

Anyway - on to the method. I am unsure exactly how much information T2W allows members to put on the forum. For now I will not post any links - it is easy enough to Google the name and find out for yourself. I see other members do post links - whether rightly or not. The author has been selling the method for well over a year, and has a blog for detailing trades at the close of each month.

So - I have attached a pic of the template. From what I can gather he uses several indicators to arrive at a strong probability of the trade continuing to go in the direction of a confirmed trend. He syas he has written the method himself, and I can see this is probably true, except that I can see elements of the AO indicator, and a multi-time-frame ADX indicator, which I have seen elsewhere. (Copied from his?)

At this stage, I am purely in demo mode. Results have been good. Can not help tweaking the setup to personalise it a bit, and I think most traders would do that. But it does not alter the signals.

The usual up/down Green/Red arrows are used, as well as smaller white ones to signal the close of the current trade. You can exit on these, or prefer to exit at the Fibs Support/Resistance which is built-in.

The only changes I made to the template, were to add some colour to the candles, and to add Spuds MTF Stochastic, which, in my view should be in every trader's toolbox. I sometimes delete the ADR window from the chart, to improve viewable screen real estate. 🙂 I am attaching the original template - I can show the tweaks later.

I have been searching for a setup that gives me confidence that the trade will continue in the current direction for at least the next time period. Of course this is fairy-land stuff. It can never be guaranteed. But for me, I think this has the potential to elevate that probability. The addition of the MTF Stochastic enhances the probability of continuance. (Not shown)

The author's use of the MTF ADX also signals the continuance of trend, and i have found it to be reliable.

I should add that there are a few parameters that need to line up prior to pulling the trigger, as well as a need to be aware of whether the current TF is ranging or trending. That is important. If you kow the trend, and only trade in that direction, it helps! 😀

At times you can get a signal that is counter to the LT trend. Experienced traders can take those, but I prefer to wait until the trend is coming back to conformity.