Stocks screeners are effective filters when you have a specific idea of the kinds of companies in which you are looking to invest. There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your own. A stock screener limits exposure to only those stocks that meet your unique parameters.

How Stock Screeners Work

Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. You can use these same tools to help you make better decisions about the stocks in which you invest your money.

Stock screening is the process of searching for companies that meet certain financial criteria. A stock screener has three components:

- A database of companies

- A set of variables

- A screening engine that finds the companies that satisfy those variables and generates a list of matches

Using a screener is quite easy. First, you answer a series of questions. They may include the following:

- Do you like large cap or small cap stocks?

- Are you looking for stock prices at all-time highs or companies with stocks that have fallen in price?

- What range for the price-to-earnings ratio (P/E) is acceptable for you?

- Are you looking for stocks in a particular industry?

Good screeners allow you to search using just about any metric or criterion you wish. When you finish inputting your answers, you get a list of stocks that meet your requirements.

By focusing on the measurable factors affecting a stock's price, stock screeners help their users perform quantitative analysis. In other words, screening focuses on tangible variables such as market capitalization, revenue, volatility, and profit margins, as well as performance ratios such as the P/E ratio or debt-to-equity ratio (D/E). For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products.

Screener Options

Some of the best free screeners on the web include those offered by Yahoo! Finance, StockFetcher, Chart Mill, Zacks, Stock Rover, Google Finance, and FinViz. They all offer users a series of basic and advanced screeners and many stock screeners offer both basic and advanced, or free and premium services.

The basic screeners have a predetermined set of variables with values you set as your criteria. For example, one of the variables on the FinViz basic screener filters stocks by market cap, giving you the option of finding companies that, for example, fall below or exceed $300 million in market capitalization.

Although there are some good free screeners out there, if you want the very latest and best technology, you will likely have to get a subscription to a screening service.

Using Customizable Screeners

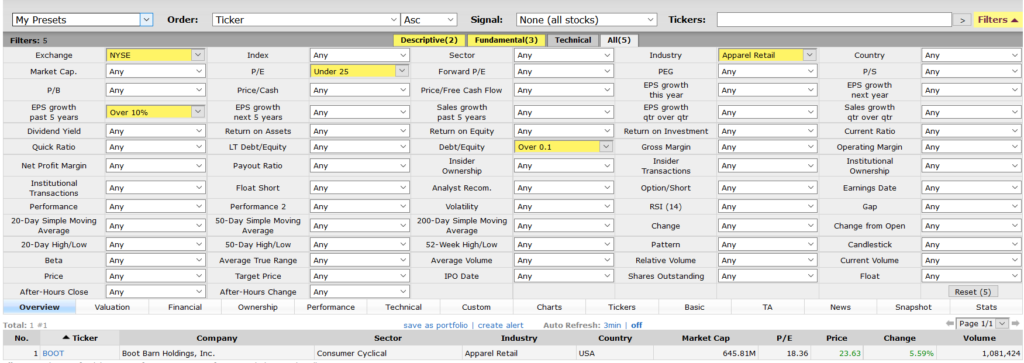

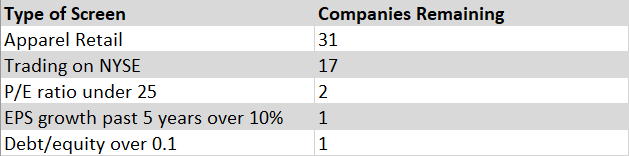

Let's say we're looking for an apparel company that trades on the New York Stock Exchange (NYSE), has a P/E ratio under 25, has an EPS growth of over 10% over the last five years, and a debt/equity ratio over 0.1.

Here is what the screener looks like on FinViz:

After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. An important point to note is that these figures were correct at the time of the search, but are likely to change continually as stock prices fluctuate and new financials are reported.

Now that we have the results of the stock screen, we have one candidate worthy of further analysis. That is, if we are confident in our criteria and the values we choose for them.

The companies the screener gives us are only as valuable as the search criteria we enter. It's also important to remember that the screen is not the analysis itself. The screen can't guarantee that the company that made all our criteria is the best purchase, so we have to dig deeper to find out more.

Knowing What to Screen For

The big challenge with using screeners is knowing what criteria to use for your search. The hundreds of variables make the possibilities for different combinations nearly endless.

Screeners are extremely flexible, but if you don't know what you're looking for or why, they can't do much for you. To help investors, some sites have predefined stock screens, which have their variables already entered.

The following sites offer some of the better-predefined screens (these are just a few examples of what's out there):

- Yahoo! Finance: This site includes three predetermined screens: Undervalued Large Caps, Day Gainers and, the most notable, Portfolio Anchors. The search criteria of each predetermined screen are clearly explained so you can understand the screens' underlying principles.

- MSN Money: This one includes a series of popular screens that can further be filtered and sorted by category.

- FinViz: This screener includes a signal dropdown menu that filters for criteria such as top gainers, recent insider buying, and wedges.

Watch Out for These Limitations

Although they are useful tools, stock screeners have some limitations. Here are some things you should keep in mind:

- Most stock screeners include only quantitative factors. There are still many qualitative factors to keep in mind. No screener provides information about things like pending lawsuits, labor problems, or customer satisfaction levels.

- Screeners use databases that update on different schedules. Always check the relevance and timeliness of the data. If a screener's data isn't timely, your search could be meaningless.

- Watch for industry-specific blind spots. For example, if you are searching for low P/E valuations, don't expect very many tech companies to show up.

A few other generic things to watch out for with these screeners. Some of the free versions come with ads, not unlike a lot of other sites. They have to make money somehow, right? This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. But if you're willing to shell out a few dollars, most come with premium options that can cut out the ads. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts.

Do Your Own Research

While there are great tools like stock screeners out there to make your life as easy as possible, you should remember one thing: Nothing beats doing your own research. Just because a stock screener gives you a list of stocks that fit your search criteria, take it with a grain of salt—just like any investment advice you receive.

As mentioned, these screeners won't necessarily know about news that affects certain companies. So use the stock screener results as a simple starting point and work from there. Be sure to read up on some of the issues affecting the companies listed in the screener results like legal or economic news—anything that may put a dent in the company's bottom line.

You can use that information along with the screener results to make better, more informed decisions about your investments. Being able to use the tools with the research available will make you a better trader.

Remember, stock screeners are not the magic pill for selecting stocks. Nothing will ever replace good old-fashioned nose-to-the-grindstone research. However, screeners can be a good place to start your research process as they can save time and narrow your options down to a more manageable group.

Brian Beers can be contacted via Twitter on this link: @brian_beers